Table of Contents

4kodiak/iStock Unreleased by using Getty Photos

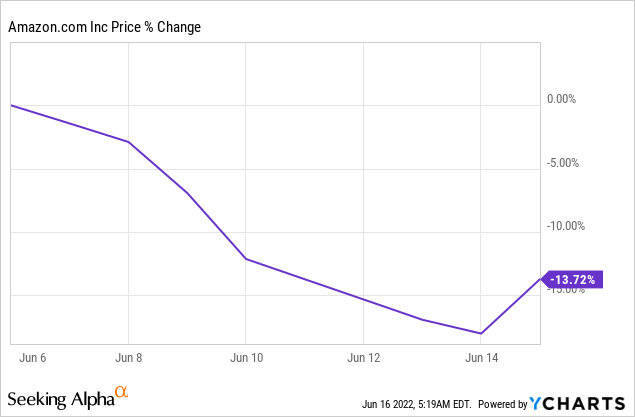

Amazon (NASDAQ:AMZN) finished its 1st stock split since 1999 previous week, offering shareholders 20 shares for each share of Amazon they formerly owned. Due to the fact the completion of the inventory split, nevertheless, shares of Amazon have declined about 14%. I consider the present-day setup is not favorable and with curiosity rates now escalating more speedily than beforehand envisioned, Amazon may perhaps be established for a big revaluation to the draw back!

Stock split did not have a constructive effect on Amazon’s stock performance and you can blame the Fed

The Fed lifted fascination fees 75 foundation factors this week, handing the sector the largest desire rate maximize in 28 yrs. The improve in interest rates to between 1.50% and 1.75% is a major offer for the company sector and individuals alike as it will have an effect on most consumer and organization loans. The Fed is hunting to do extra to struggle inflation, but additional level boosts also raise economic downturn pitfalls.

Amazon’s stock split, at minimum so significantly, was not a large accomplishment for shareholders… with shares declining about 14% considering the fact that June 6. Inventory splits could boost limited-expression returns for shareholders, but Amazon’s stock split has so much failed to lure investors back again into the stock. Year to date, shares of Amazon are down 36% and challenges are only rising.

Larger curiosity charges and USD toughness are challenges for Amazon’s intercontinental business enterprise

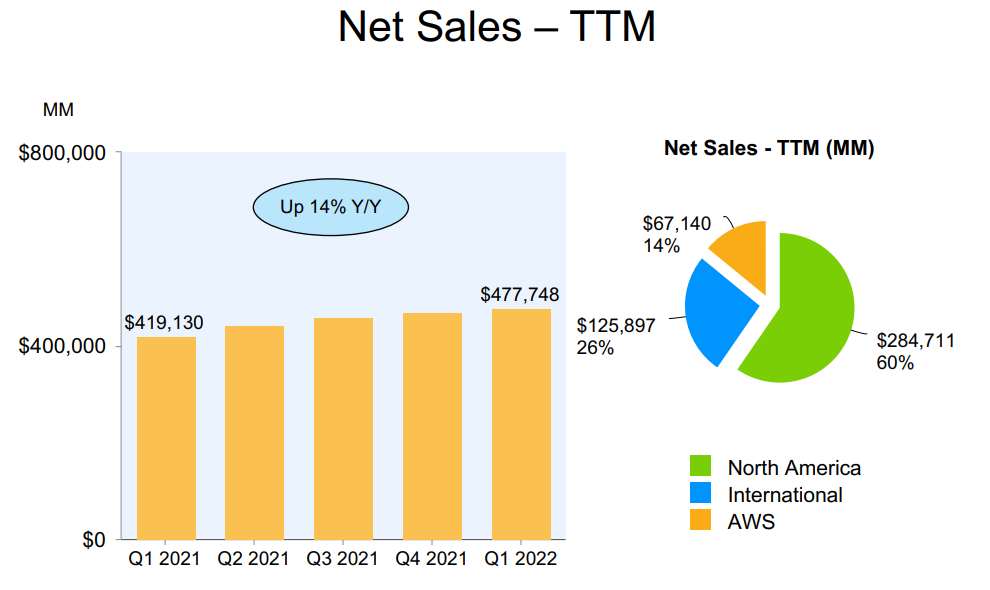

Amazon produced $477.7B in net product sales in excess of the very last twelve months, of which about 60% have been produced in North The united states. Close to 26% of revenues come from Amazon’s worldwide e-Commerce organization when 14% of revenues had been contributed by Amazon’s quickly increasing Amazon Web Providers business enterprise. The difficulty that I see with Amazon’s worldwide e-Commerce functions is the latest USD energy which can make it more challenging for U.S. corporations to contend. The USD has appreciated from important currencies in 2022 and is almost at parity with the EUR, in element since of expectations about aggressive fascination fee improves in the United States in 2022 and 2023. The Fed yesterday said that it expects desire fees to go to 3.4% by the end of 2022 and then to 3.8% in 2023.

Regrettably for organizations like Amazon, which accomplish a large proportion of revenues in currencies other than USD, the appreciation of the USD represents a really serious income problem heading forward and it could bring about shares to revalue even lessen.

Amazon

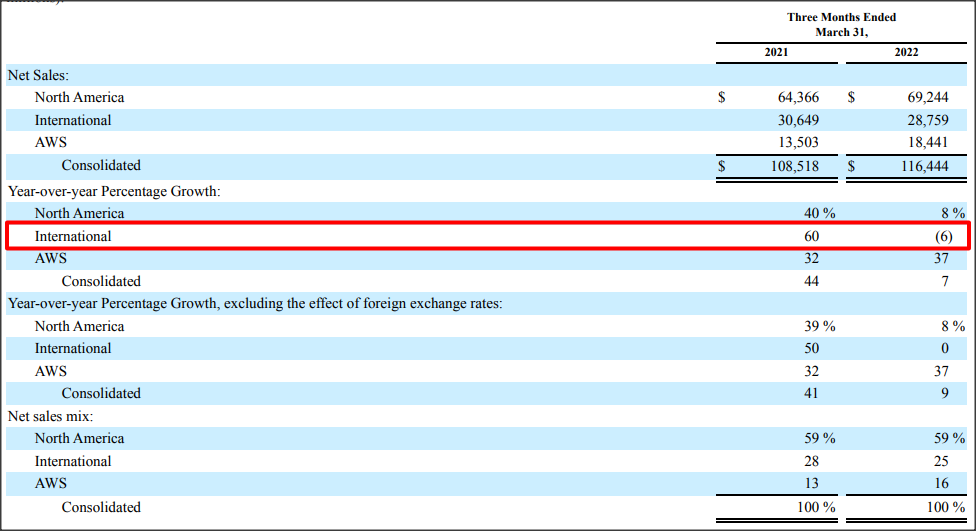

The international small business was the speediest-growing enterprise for Amazon in 2021, with revenues increasing almost two times as speedy as Amazon Net Services grew its leading line. In Q1’22, nevertheless, the more powerful USD previously impacted Amazon’s monetary effects in materials techniques, resulting in a damaging web product sales impact of $1.8B. Amazon’s worldwide internet revenue, as revealed beneath, reduced 6% calendar year over 12 months in the initial-quarter, chiefly due to unfavorable forex developments.

Amazon

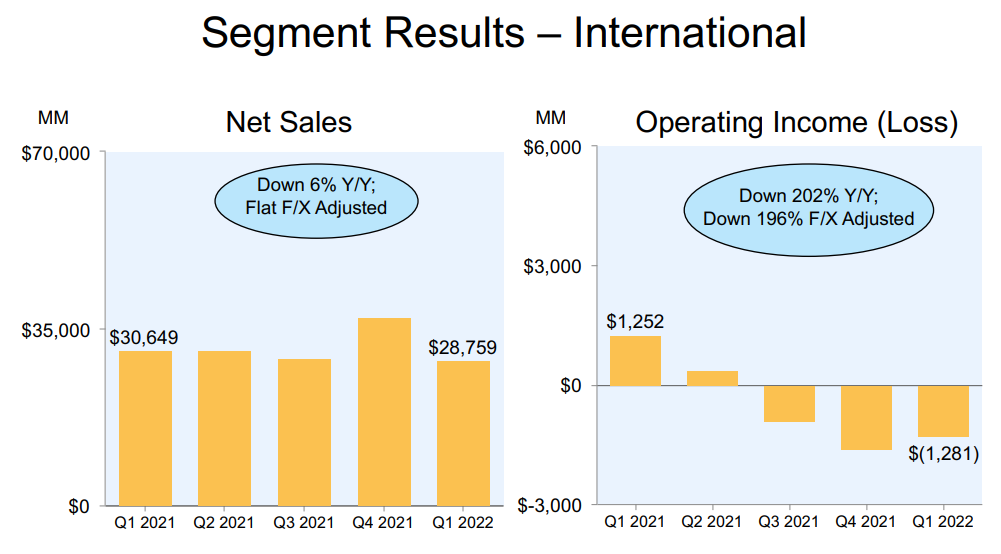

Running revenue risks are expanding

Amazon World-wide-web Products and services has been a vibrant place for Amazon in the very last year, with advancement surging at a time when the e-Commerce small business, both of those in the U.S. and internationally, confirmed indicators of a put up-COVID normalization. In the very first-quarter, only Amazon Internet Services built a optimistic working money contribution of $6.5B although Amazon’s U.S. and global functions collectively made a $2.8B decline. In Q1’22, Amazon’s functioning profits declined 60% calendar year around year to $3.7B, forex-adjusted, with worldwide operating earnings dropping off a significant 196% year about year to $(1.3B).

Amazon

Heading forward, I see additional profits threats originating from a continuous slowdown in e-Commerce product sales, such as 3rd-celebration profits, on the Amazon platform need to a recession strike. Continual USD energy may well also translate to weaker USD revenue for Amazon.

Amazon has more draw back

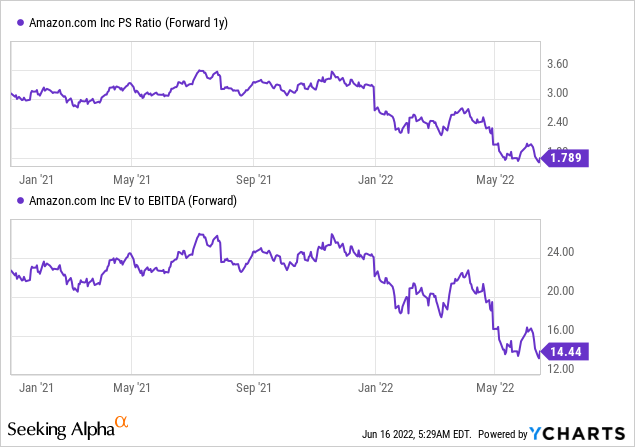

E-Commerce companies, experiencing significantly lowered growth anticipations publish-COVID, may perhaps still be regarded pricey. Amazon’s progress is also expected to average materially in the coming decades and estimates at the moment never even account for supplemental USD energy and recession impacts. Amazon is predicted to improve revenues between 12-17% annually in excess of the next 5 yrs but expansion charges could be noticeably lower if a U.S. recession further spoils Amazon’s business benefits. Based mostly off of revenues for FY 2023, shares of Amazon have a P-S ratio of 1.8 X.

Looking for Alpha

Traditionally, Amazon has sold at considerably bigger valuation variables…

Challenges with Amazon

Amazon is going through a double-whammy: A economic downturn-induced slowdown in income on the Amazon system could spoil the development outlook while an even much better USD would also take in up billions of bucks in net income. While Amazon World-wide-web Providers is likely going to do properly thanks to favorable adoption trends in the sector, Amazon’s period of hyper-expansion is coming promptly to an close. For the inventory, this could suggest even extra issues than it now went by. Slowing top line progress and declining profitability, particularly in Amazon’s worldwide small business, are serious difficulties for Amazon’s shares likely forward.

Closing thoughts

Now that Amazon finished its inventory break up, buyers are likely to return their notice to Amazon’s platform effectiveness, especially in the e-Commerce company which has unsuccessful to make good functioning revenue contributions as of late. Even though the inventory break up has reduced Amazon’s stock value — which could make the stock far more accessible — I imagine Amazon’s shares are currently not a invest in thanks to expected currency headwinds and increasing working cash flow risks linked to Amazon’s worldwide functions. Amazon Web Companies is a bright spot for Amazon, but cloud effectiveness could not be sufficient to preserve Amazon’s benefits in a recession that at the same time sees significant inflation as very well as a solid USD!

.png#keepProtocol)

.png#keepProtocol)

More Stories

Level Up Your Career With These 7 Professional Development Tips

Donald Trump Gets a Solution to His Cash Problem

Crypto Exchange Gemini To Refund $1.1B To Earn Program Customers