A lineup of post-pandemic music concerts, from Coldplay to Blackpink, has driven more Indonesians to turn to fintech lending to get quick funds.

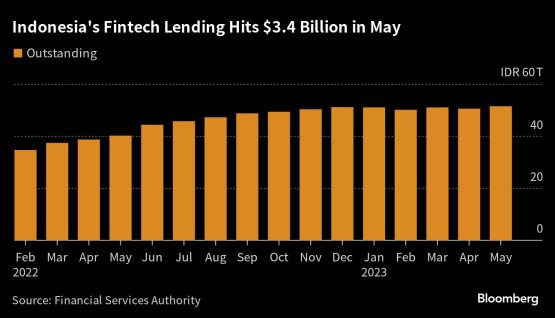

Outstanding loans from digital platforms reached 51.5 trillion rupiah ($3.4 billion) in May, up 28% from a year ago, according to the Financial Services Authority, or OJK. Now the regulator is warning borrowers to be wary and not to borrow beyond their means.

“Most of those who have difficulty paying off loans usually borrow for consumer needs, for example buying new gadgets, recreation, fashion, and even recently to buy concert tickets,” OJK Commissioner Friderica Widyasari Dewi said in a briefing Tuesday.

Smartphone penetration is outpacing the growth of banking access in Southeast Asia’s biggest economy, enabling internet-based financial services to grow rapidly as an alternative to conventional lenders to help small businesses get funds to expand. But more than half of outstanding loans are still concentrated in Jakarta and the neighboring West Java, and only about 40% of the funds go to small businesses.

The ratio of bad online loans – credit that borrowers don’t pay back for more than 90 days from maturity — also rose to 3.36% in May, from 2.78% at the end of 2022, even if it’s still below the 5% threshold set by the regulator.

“We continue to advise people to understand the risks of online lending, especially the dangers of illegal fintech,” said Dewi.

© 2023 Bloomberg

.png#keepProtocol)

.png#keepProtocol)

More Stories

Employee Appreciation Day: How to build a culture of year-round recognition

Data Never Sleeps Turns 11!

George Jenkins’ Alyssa Currie signs first bowling scholarship in school history