Extra crypto traders are locating their Bitcoin investments underwater and may perhaps be ready to throw in the towel.

The amount of anonymous Bitcoin addresses in the money, that means people that acquired their holdings at costs below today’s, has achieved lows not seen considering that March of 2020, according to Bequant, a electronic-asset company. The stage, at the moment hovering around 51%, “points to capitulation,” though bear marketplaces in 2015 and 2018 noticed even decrease lows, wrote Martha Reyes and Emiliano Bruno in a note.

Crypto costs have been in a slump this year as the Federal Reserve withdraws stimulus and hikes prices to fight inflation. The natural environment has been harmful for all fashion of riskier belongings, like richly valued tech corporations. But cryptocurrencies have been hit significantly difficult, with Bitcoin losing a lot more than a third of its worth this year, and other people, which includes Ether, shedding 50%. Even Bitcoin miners have commenced to offload tokens they had hoarded as lots of are looking at handful of signs charges could recover quickly.

“It feels incredibly significantly to me like crypto is also matter to a great deal of the monetary cycle that’s been hitting the far more classic asset courses,” Kara Murphy, CIO of Kestra Holdings, stated. “Looking at the fast enhance in crypto selling prices, it appears distinct that they truly benefited from straightforward-income policies, and now that the revenue is coming out of the program, that is a fantastic section of the purpose why crypto is declining more lately.”

In its second consecutive session decreased, Bitcoin fell as significantly as 4.8% on Wednesday to trade close to $29,800.

With charges investing at the decreased conclusion of the last 17-thirty day period range, the bulk of prospective buyers over that span are keeping unrealized losses, in accordance to strategists at Glassnode, who cite some thing called the Net Unrealized Earnings/Decline metric, or NUPL, which maps out unrealized profits and losses as a proportion of industry benefit. Because early May possibly, the measure has fluctuated in a variety of close to 18% to 25%, “indicating considerably less than 25% of the market cap is held in earnings,” they wrote. They say the $20,560 to $23,600 span is the place the evaluate “would suggest a complete-scale capitulation scenario.”

To be confident, it’s not likely that a whole lot of crypto “OGs”, which means all those who acquired early on at extremely small rate ranges, are dumping their holdings, mentioned Wilfred Daye, main executive officer of Securitize Cash, a digital-asset administration firm. But those who acquired in the latest months might be extra possible to provide.

“There may perhaps be capitulation mainly because larger sized institutional players, fellas who bought in all through the present cycle, they are at possibility of providing their belongings and liquidating their belongings,” Daye said. “This unique cycle that begun late 2020, you experienced a great deal of institutional people acquiring in at a better selling price, so I assume it’s more institutional capitulation.”

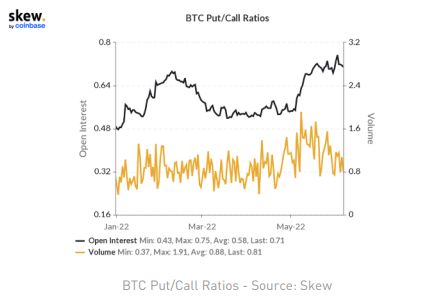

And sentiment stays bitter however. The Bitcoin put-to-phone ratio hit a current large of .75 last week, in accordance to Skew details compiled by Babel Finance.

That signifies that “traders continue on to obtain places for cost protection or glance to gain from BTC’s cost drop,” Babel strategists wrote in a notice.

© 2022 Bloomberg L.P.

.png#keepProtocol)

.png#keepProtocol)

More Stories

Level Up Your Career With These 7 Professional Development Tips

Donald Trump Gets a Solution to His Cash Problem

Crypto Exchange Gemini To Refund $1.1B To Earn Program Customers