Table of Contents

It’s been a difficult year for business owners seeking financing, according to NerdWallet’s 2023 Small-Business Financing Index. While loan volumes are relatively stable, high interest rates and low optimism may make some entrepreneurs reluctant to apply for funding.

“Small businesses are facing … a lending downturn and definitely the threat of an impending recession,” says Carolina Martinez, CEO of the California Association for Micro Enterprise Opportunity, an advocacy group focused on very small businesses. “We’ve seen a lot of small businesses not applying directly to banks, thinking they’re not going to be approved.”

Advertisement

Article continues below this ad

As interest rates rise, financial institutions tend to tighten their lending standards. To compete, small-business owners should focus on maintaining clean books and shopping around for lenders willing to work with them — even if it takes a little longer to get funding.

“It is important for a small business to not prioritize how fast they can get the money over what kind of money they are getting,” Martinez says.

Financing index trails 2022

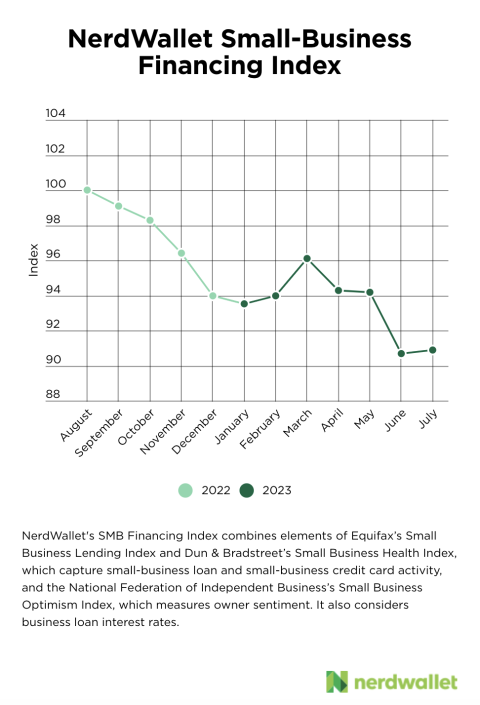

NerdWallet’s Small-Business Financing Index was in the 100s as recently as August 2022. But since then, it has fallen to new lows of around 91. This indicates that small-business owners are facing higher interest rates, using less financing, having more trouble keeping up with bills and feeling less optimistic about their futures than they were in our last report a year ago.

Advertisement

Article continues below this ad

NerdWallet’s Small-Business Financing Index began tracking data from multiple sources in December 2021. That month earned a score of 100, and all subsequent readings are relative. For example, an index reading of 80 is 80% of the number recorded in December 2021.

NerdWallet monitors this data to understand the ability of small businesses to receive, manage and repay financing. In general, more financing activity and fewer delinquencies indicate a stronger economic climate for small businesses. Less financing activity and more delinquencies indicate that businesses are having a harder time both getting and repaying loans.

The index held relatively steady through the first five months of 2023, with a spike in March reflecting a particularly high volume of loans that month.

Advertisement

Article continues below this ad

But in June, it dropped to a new low — 90.7, down from 99.2 a year previously. And July’s reading was 90.9. High interest rates drag the index downward, and this summer also saw relatively high levels of credit card and payment delinquencies.

Need financing now? Try these tips

To get a business loan in a tough environment, entrepreneurs should follow these five tips to put their best foot forward and find alternative sources of funding.

1. Improve your financial records

Advertisement

Article continues below this ad

Business loan applications typically include your personal and business credit scores, details about your company’s history, business plan and revenue.

To make those documents as strong as possible, you may want to include monthly balance sheets and income statements instead of annual ones, says John Bovard, a Cincinnati-based certified financial planner and owner of Incline Wealth Advisors.

“If you have an annual balance sheet statement, it doesn’t really tell the whole story of your business, especially if it’s a cyclical business,” Bovard says.

2. Turn to local or regional banks

Advertisement

Article continues below this ad

If you don’t already have a relationship with a bank or credit union in your community, now might be a good time to start one.

Matt Mylet, vice president and commercial team leader at Beneficial State Bank, a West Coast regional bank, says smaller banks often will take more time to look at a business’s trends and operating model to get a better feel for its performance.

“We really want to try to support businesses in the community as much as we can,” he says. “We’re willing to give them the benefit of the doubt if it’s close.”

Even if these banks agree that you’re not ready for a loan yet, they may be able to point you to other alternative lenders.

Advertisement

Article continues below this ad

3. Try a CDFI

Community development financial institutions (CDFIs) aren’t banks. Instead, they’re mission-driven organizations focused on building up their communities.

“Banks usually have the lowest interest rates on the market, but not everybody is able to acquire capital through them. So CDFIs are the best next step,” Martinez says.

CDFIs usually make smaller loans than banks do, including microloans. But they also tend to have less rigid underwriting criteria and may be able to offer lower interest rates than other alternative lenders.

Advertisement

Article continues below this ad

“Very small businesses, startups looking for working capital, are great definitions of the traditional businesses CDFIs work with,” Martinez says — and also the types of businesses that may struggle to qualify for bank financing.

4. Ask about vendor financing

Placing a large order for equipment or materials? See if the seller is willing to finance your purchase. Establishing trade lines with suppliers can help build your business credit, too.

“Whoever you’re buying your equipment from, look and see if they have leasing departments,” Bovard says. “That way, you can somewhat avoid a bank.”

Advertisement

Article continues below this ad

You can also ask your network to recommend nonbank lenders, like private equity firms, Bovard says.

5. Use credit carefully while interest rates are high

Business lines of credit and business credit cards often have variable interest rates. As interest rates rise nationwide, interest rates on these products may go up, too.

If you use credit regularly to bridge gaps in cash flow or stock up for your busy season, higher interest rates “can make a significant impact on your business,” Bovard says.

Advertisement

Article continues below this ad

Monitor the impact of interest rate increases on your repayments, and limit your use of credit, if you can. If not, you may want to refinance that debt to a fixed-rate term loan.

“Right now, for term rates, those are typically around 6%,” Bovard says. “Compare that to an 8.75% rate on a line of credit that’s variable — that’s where it gets frustrating for business owner clients.”

Methodology

NerdWallet’s SMB Financing Index combines elements of Equifax’s Small Business Lending Index and Dun & Bradstreet’s Small Business Health Index, which capture small-business loan and small-business credit card activity, and the National Federation of Independent Business’s Small Business Optimism Index, which measures business owner sentiment. It also considers business loan interest rates.

Advertisement

Article continues below this ad

The article Entrepreneurs Feeling Less Optimistic as Rates Rise, Data Shows originally appeared on NerdWallet.

More Stories

The Key to Boosting Retention

Kim Jong Un Unveils Ambitious ‘Regional Development Policy’ To Modernize Rural North Korea Amid Food Shortages

Industry Leader Revolutionizes Business Financing Through Credit Stacking