Table of Contents

Most important Avenue continues to be resilient regardless of the more and more very long record of difficulties and countercurrents it need to contend with. SMB entrepreneurs and staff members have an increasingly lengthy record of problems to contend with: Shopper selling prices amplified at the optimum fee in 40 a long time in June. On the employment and using the services of fronts, some of the greatest and most popular world providers announced layoffs, selecting freezes, or using the services of slowdowns. Client self confidence and sentiment are lessen.

Authorities also now estimate a greater probability of a recession inside the up coming yr given the impact of inflation on corporate earnings and Fed policy imperatives. Wall Avenue analysts proceed to decrease earnings and benchmark index estimates. Bellwether providers these as Walmart have lowered their earnings estimates citing slowing buyer retail revenue. Jobless promises continue to rise and are now at the highest weekly amount since November 2021. Optimistic news includes falling commodity charges, including for oil reduced home loan and desire prices and a still robust choosing sector.

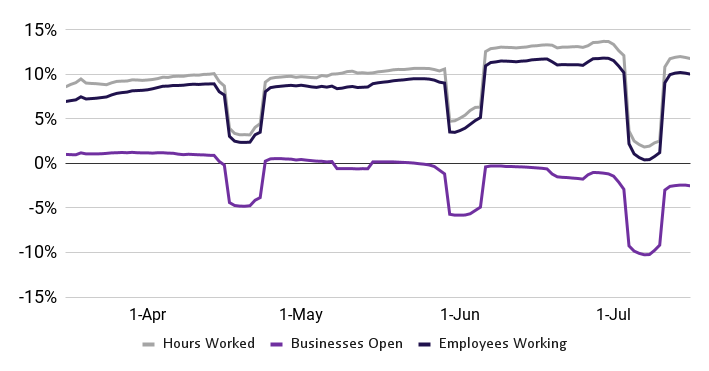

Our personal key Primary Road Health and fitness Metrics for July uncovered some softening in several hours labored (a reduction of roughly 12%) and staff members doing the job relative to June. Nonetheless, these metrics keep on being increased relative to January of 2022 and evaluate favorably to the pre-pandemic time period.

Primary Road Health and fitness Metrics

(Rolling 7-day common relative to Jan. 2022)

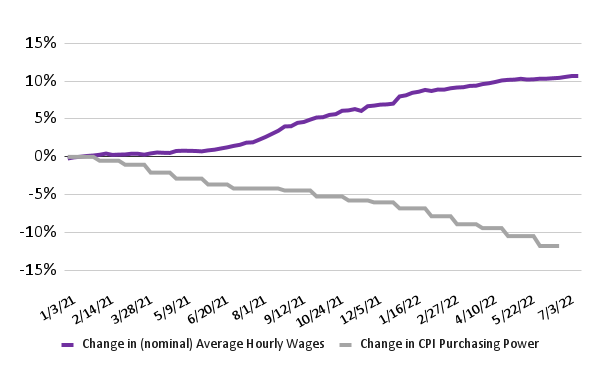

Nominal average hourly wages are up practically 10% considering that the starting of 2021. Ordinary (nominal) hourly wages in mid-June remained approximately 10% higher than estimates from January of 2021. Evidence from mid-July implies that wage inflation increased reasonably relative to June and has not stored up with inflation.

Per cent modify in nominal common hourly wages and CPI Acquiring Electric power of the Customer Greenback relative to January 2021 baseline1

1. Nominal regular hourly wage changes and the (month to month) CPI for all Urban Customers: Obtaining Electricity of the Client Greenback in U.S. Metropolis Regular (non-seasonally adjusted) calculated relative to a January 2021 baseline. Resources: Homebase facts, U.S. BLS.

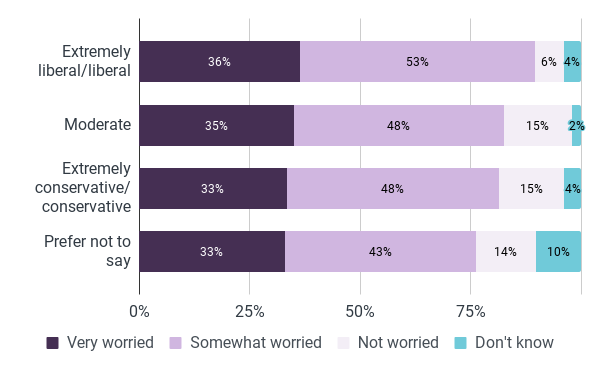

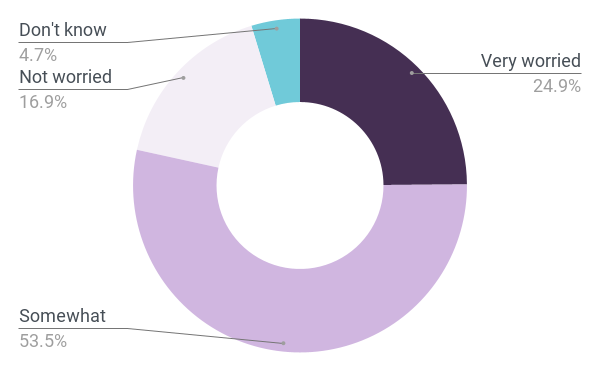

Most staff members are concerned about a recession there is some variation based on political orientation. Based on a pulse study of close to 700 workers executed in mid-July, we observed that staff members are both quite (32%) or somewhat (47%) worried about a economic downturn. There is, on the other hand, some variation (from an all round large baseline) based mostly on political orientation. Nearly 90% of individuals who discover as both exceptionally liberal or liberal are both incredibly or somewhat concerned about a recession. For moderates, the determine is 82.5% and for conservatives it is 81.4%. These who favored not to identify their political orientation ended up comparatively much less worried about a recession at a continue to large 76%. One achievable explanation is the perceived effects the economic climate may possibly have on the November elections.

Survey issue: Are you anxious about a recession?

Source: Homebase Worker Pulse Survey. LR-Chi Square = 24.5, p < 0.004

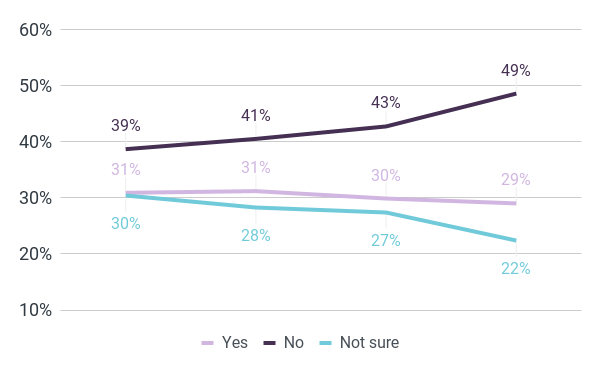

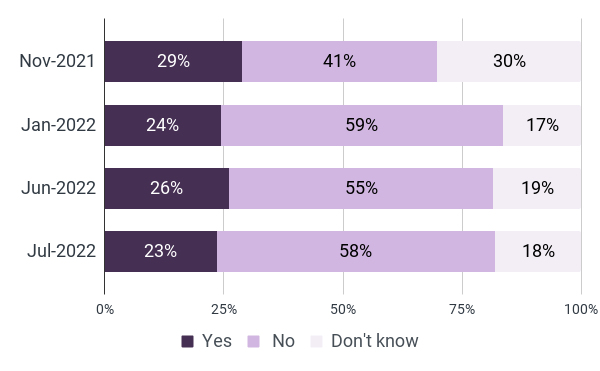

Maybe my current job is not so bad? Macro-economic and social forces have changed how employees regard their current jobs and alternative job options. 49% of employees surveyed in July indicated they do not intend to search for a new job in the next one to two years. This compares with 41% in January of 2022 and 39% in November 2021.

Survey question: Do you intend to look for a new job in the next 12-24 months?

Source: Homebase Employee Pulse Surveys. Ns = November (2324), January (548), June (1767), July (710).

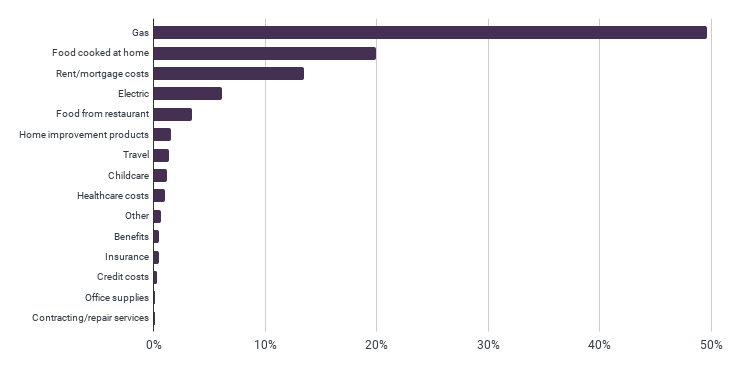

The cost of gas is the item most impacted by inflation. Food costs and rent or mortgage round out the top three categories. Consistent with CPI data, the cost of gas was cited most frequently (50%) as the category most impacted by inflation. The cost of food cooked in one’s home was ranked first by approximately 20% of employees, followed by rent or mortgage costs (approximately 13%). As one employee put it:

“I can’t afford anything. Anything. Prices are so high and I was barely scraping by as it was.”

Survey question: Which of your monthly costs have been most impacted by inflation?

Source: Homebase Employee Pulse Survey.

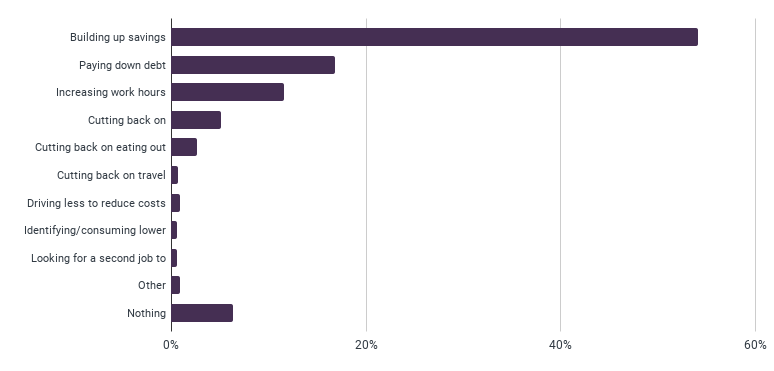

Most employees are concerned about a recession they are also taking steps to prepare for one. To prepare for a possible recession, employees are building up savings (54%) and paying down debt (17%). Interestingly, however, only 5% are cutting down on entertainment (e.g., going to movies, amusement parks), eating out at restaurants (3%), or travel (<1%). These findings are consistent with recent reports indicating continued consumer strength in these categories. Finally, less than one percent of employees indicate that they are looking to switch to lower priced products/services to prepare for a recession.

Survey question: Which steps, if any, are you taking to prepare for a recession?

Source: Homebase Employee Pulse Survey.

Much like their hourly employees, most owners are concerned about a recession. A July pulse survey of approximately five hundred owners reveals the ubiquity of recession fears.

Survey question: Are you worried about a recession?

Source: Homebase Employee Pulse Survey.

Given the ubiquity of recession fears, most owners do not plan on opening new locations. Results from July 2022 resemble results from January 2022 when Omicron impacted business (planning). From June to July 2022, the percentage of owners who intend to open a new location in the next one to two years decreased by approximately 3 percentage points with a corresponding increase in the percentage of owners who indicated they do not intend on opening a new location in the corresponding period.

Survey question: Do you intend to open a new location of your business in the next one to two years?

Source: Homebase Employee Pulse Survey.

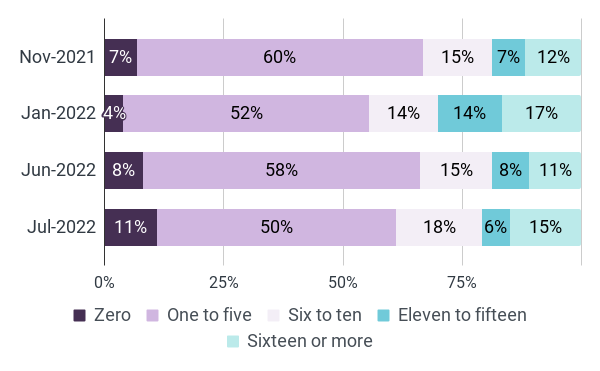

Owners’ hiring intentions for the next one to two years are changing. However, the vast majority of owners intend to hire and the overall average implies a headcount increase of 30%. Most small business owners intend to hire additional employees in the next one to two years. However, since January of 2022, a pattern is emerging where an increasing percentage of owners are either planning on making no additional hires or are planning on significantly increasing headcount. The percentage of owners who now intend to make no additional hires increased more than 37% since June and nearly tripled relative to January. On the other hand, approximately 21% of owners plan on hiring eleven or more employees.

Survey question: How many additional workers do you intend on hiring in the next one to two years?

Source: Homebase Employee Pulse Survey.

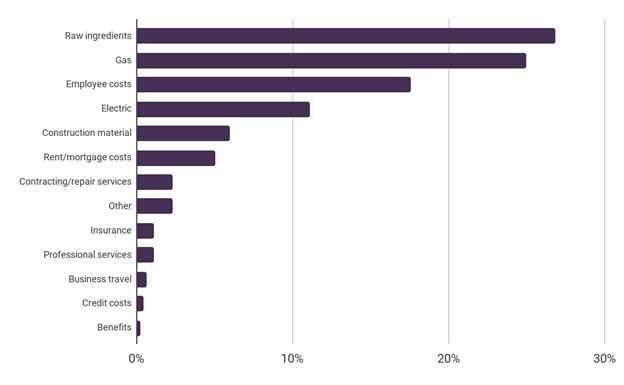

Twenty-seven percent of owners ranked the price of raw ingredients or intermediate goods as the cost that has been most impacted by inflation. The cost of gas was a close second (25%), followed by employee salary costs (18%). The cost of electricity (11%) and construction materials (6%) round out the top five. As one owner put it:

“Increase in prices for raw ingredients, supply chain issues and shortages of many items, combined with the now due payments will have a large negative impact on my business.”

Survey question: Which of your monthly costs have been most impacted by inflation?

Source: Homebase Employee Pulse Survey.

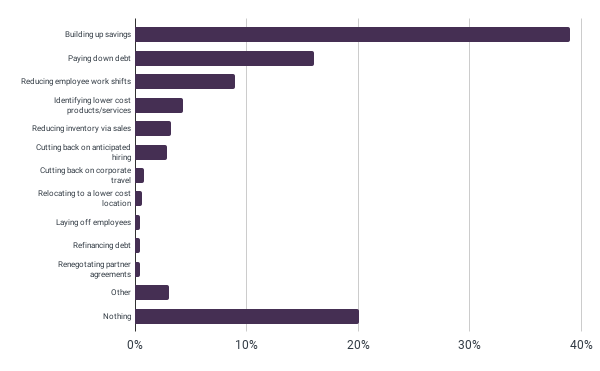

Most owners are concerned about a recession they are also taking steps to prepare for one. To prepare for a possible recession, owners are taking similar steps as their employees: First, they are building up savings (39%). Second, they are paying down debt (16%). Third, they are reducing employee work shifts (9%). Less than 0.5% of owners are preemptively laying off employees to prepare for a possible recession.

.png#keepProtocol)

.png#keepProtocol)

More Stories

Level Up Your Career With These 7 Professional Development Tips

Donald Trump Gets a Solution to His Cash Problem

Crypto Exchange Gemini To Refund $1.1B To Earn Program Customers