Critical Advisors Group LLC co-operator Eddie Ghabour discusses the recent condition of the current market and the Federal Reserve on ‘Varney & Co.’

Inflation remained painfully superior in May perhaps, with shopper rates hitting a new 4-ten years substantial that exacerbated a monetary strain for thousands and thousands of People and worsened a political disaster for President Biden.

The Labor Division said Friday that the shopper rate index, a wide evaluate of the rate for everyday merchandise, which include gasoline, groceries and rents, rose 8.6% in May perhaps from a year in the past. Price ranges jumped 1% in the just one-month period from April. People figures ended up the two bigger than the 8.3% headline figure and .7% every month achieve forecast by Refinitiv economists.

INFLATION TIMELINE: MAPPING THE BIDEN ADMIN’S Reaction TO Quick Value Progress

It marks the fastest speed of Inflation considering that December 1981.

So-called core charges, which exclude more risky measurements of food items and energy, climbed 6% from the former year, also additional than Refinitiv predicted. Main selling prices also rose .6% on a every month basis, suggesting that underlying inflationary pressures remain strong.

“What an unattractive CPI print. Not only was it greater than expected on virtually all fronts, pressures were evidently obvious in the stickier elements of the industry,” stated Seema Shah, main strategist at Principal International Buyers. “The decline in inflation, whenever that last but not least occurs, will be painfully slow.”

Cost increases were being widespread: Energy costs rose 3.9% in May well from the prior month, and are up 34.6% from previous year. Gasoline, on typical, expenditures 48.7% extra than it did one 12 months back and 7.8% extra than it did in April. In all, gasoline price ranges jumped 16.9% in May on a month to month basis, pushing the 1-calendar year enhance to a beautiful 106.7%.

In a different worrisome signal, shelter fees – which account for approximately just one-3rd of the CPI – accelerated in May perhaps, climbing .6%. It marked the fastest one-thirty day period obtain because 2004. On an yearly basis, shelter expenditures have climbed 5.5%, the fastest considering the fact that February 1991.

Meals prices have also climbed 10.1% bigger about the calendar year and 1.2% around the month, with the major increases in dairy and relevant solutions (up 2.9%, the largest monthly improve considering that July 2007), non-alcoholic drinks (1.7%), cereals and bakery products (1.5%), and meats, poultry, fish and eggs rose (1.1%).

Customers wait in line at a Costco wholesale retail outlet in Orlando. (Paul Hennessy/SOPA Illustrations or photos/LightRocket by means of / Getty Visuals)

Scorching hot inflation has established severe fiscal pressures for most U.S. homes, which are pressured to pay back additional day-to-day necessities like foodstuff, gasoline and hire. The stress is disproportionately borne by lower-cash flow Individuals, whose by now-stretched paychecks are heavily impacted by rate fluctuations.

Climbing costs are consuming away the sturdy wage gains that American staff have seen in the latest months: Actual typical hourly earnings diminished .6% in Could from the prior month, as the inflation maximize eroded the .3% complete wage obtain, according to the Labor Section. On an once-a-year basis, true earnings really dropped 3% in May.

GET FOX Business enterprise ON THE GO BY CLICKING Below

Rampant inflation has become a key political liability for Biden ahead of the November midterm elections, in which Democrats are predicted to lose their now razor-thin majorities. Surveys show that People see inflation as the greatest dilemma facing the state – and that quite a few households blame Biden for the value spike.

The hotter-than-expected report will also have major implications for the Federal Reserve, probably solidifying a collection of intense amount hikes as central lender officers try to tame inflation. Policymakers currently elevated the benchmark interest rate by 50-basis factors – double the typical size – in May and are envisioned to approve at least two more in the same way sized hikes in June and July.

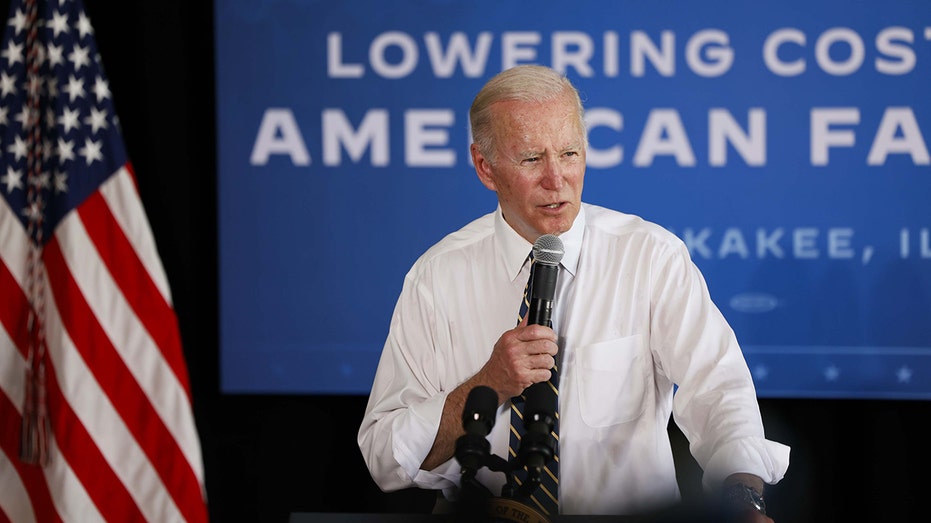

President Joe Biden speaks throughout a pay a visit to to a loved ones farm in Kankakee, Illinois, on Might 11, 2022. (Taylor Glascock/Bloomberg by using Getty Pictures / Getty Images)

Close to 98% of investors now count on the Fed to have out yet another 50 %-place charge hike in September as inflation stays stubbornly large, according to the CME FedWatch instrument.

Even now, the Fed is in a precarious problem as it walks the line among cooling shopper demand from customers and bringing inflation nearer to its 2% concentrate on devoid of inadvertently dragging the economic system into a recession. Hiking fees tends to develop bigger prices on consumer and company financial loans, which slows the economy by forcing companies to cut back again on paying out.

“The Fed is now among a rock and a pretty tricky position,” said Peter Earle, a analysis fellow at the American Institute for Economic Exploration. “Acting a lot more aggressively to stem the rise in price ranges heightens the probability of resulting in a economic downturn.”

.png#keepProtocol)

.png#keepProtocol)

More Stories

Level Up Your Career With These 7 Professional Development Tips

Donald Trump Gets a Solution to His Cash Problem

Crypto Exchange Gemini To Refund $1.1B To Earn Program Customers