Table of Contents

Article content

(Bloomberg) — The British pound notched the best performance among its Group-of-10 counterparts in the second quarter as policymakers ratcheted up interest rates to battle inflation and sparked fears of greater economic headwinds.

Article content

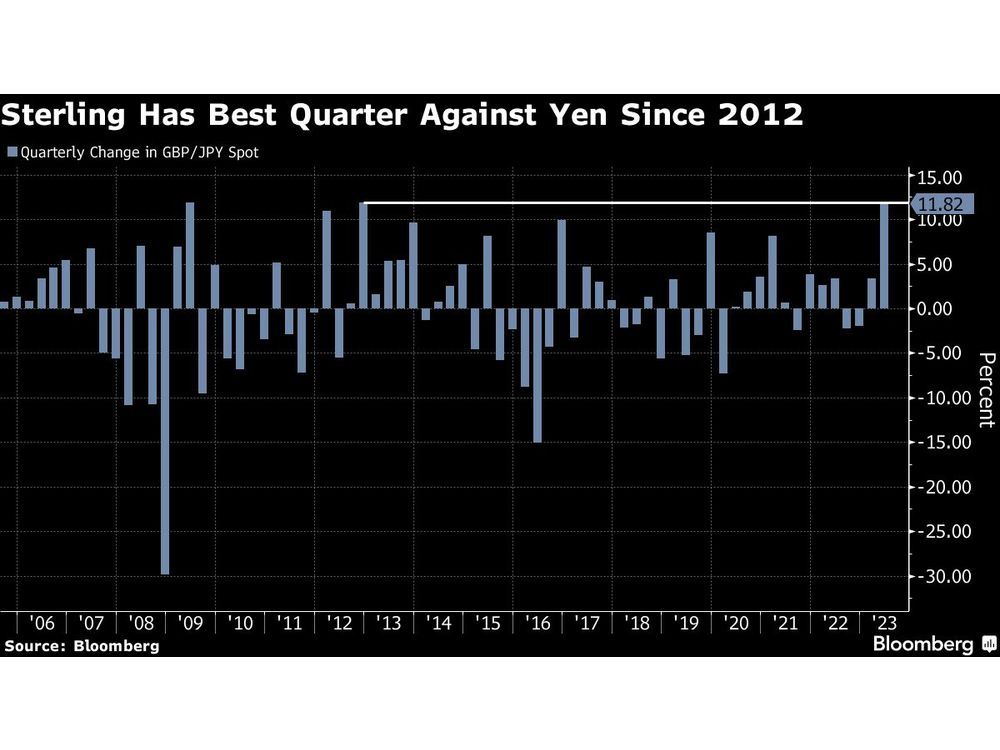

Sterling rose almost 3% versus the US dollar in the three-month period, gaining for a third straight quarter in the longest run since mid-2021. Against the yen, the worst performer in the second quarter, the pound scored its biggest advance in more than a decade, climbing 12% as the Bank of Japan kept its monetary policy ultra loose.

Article content

The UK currency has been boosted by surging bond yields, a reflection of investors’ expectations that the Bank of England is still far from wrapping up its tightening cycle. Policymakers surprised the market in June by accelerating its pace of hikes with a half-point increase to 5% to fight inflation that has exceeded forecasts for four consecutive months.

“What’s surprising given the rate expectation divergence is that the pound hasn’t rallied more,” said Jay Zhao-Murray, a currency analyst at Monex Canada in Toronto. “We think this is largely because the UK economy is at a point where higher rate expectations are fueling growth fears.”

Article content

Money markets price the key rate being raised to 6.3% by February, the highest since 1998, according to swaps tied to the central bank’s meeting dates. Schroders Plc last week revised its call to forecast the UK rate will climb to 6.5%, with the BOE firmly set on prioritizing inflation over growth.

Whether the UK currency’s rally can be sustained remains under debate as rising borrowing costs point to hardships for households and businesses. The gilt market is also flashing warning signals, with the yield curve inverting to levels not seen in decades. Even the pound has shown signs of weakness, retreating from highs reached earlier last month.

—With assistance from Carter Johnson.

.png#keepProtocol)

.png#keepProtocol)

More Stories

Big Bridge Sways 2024

Top 11 Free 3D Modeling Software in 2024

Shanghai cooperation zone to bolster links between domestic, global players