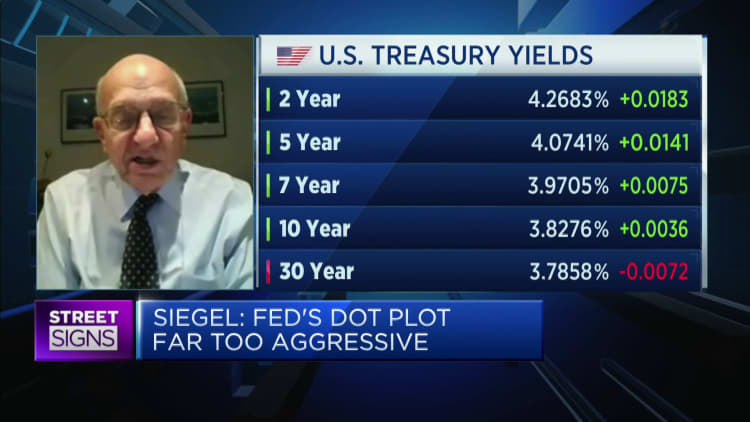

The U.S. Federal Reserve has been boosting costs much too promptly, and economic downturn dangers will be “very” large if it continues to do so, claimed Jeremy Siegel, professor emeritus of finance at the Wharton University of the University of Pennsylvania.

“They need to have started out tightening significantly, a lot substantially before,” he instructed CNBC’s “Street Signs Asia” on Friday. “But now I anxiety that they’re slamming on the brakes way much too tricky.”

Siegel claimed he was one of the initially to alert of the Fed’s “inflationary guidelines” in 2020 and 2021, but “the pendulum has swung too far in the other direction.”

“If they keep as limited as they say they will, continuing to hike prices through even the early section of upcoming yr, the challenges of recession are particularly significant,” he mentioned.

Most of the inflation is driving us, and then the most important risk is recession, not inflation, right now.

Jeremy Siegel

Wharton professor

Official info, which normally lags by a thirty day period, could not promptly display the modifications happening in the actual financial system, he reported. “Most of the inflation is behind us, and then the greatest threat is recession, not inflation, nowadays.”

Siegel reported he thinks interest prices are large adequate that they could bring inflation down to 2%, and the terminal level, or conclusion point, should be amongst 3.75% and 4%.

In September, the Fed raised benchmark interest rates by an additional a few-quarters of a percentage issue to a assortment of 3%-3.25%, the greatest it has been due to the fact early 2008. The central bank also signaled that the terminal charge could be as high as 4.6% in 2023.

“I think that that is way, way as well superior — offered the policy lags, that definitely would drive a contraction,” he claimed.

According to the CME Group’s FedWatch tracker of Fed resources futures bets, the chance that the goal vary of fees will reach 4.5% to 4.75% in February up coming year is at 58.3%.

If it were up to him, Siegel explained, he would hike prices by 50 % a place in November, then wait around and see. If commodity selling prices start to rise and dollars supply boosts, the Fed would have to do additional.

“But my experience is that when I search at sensitive commodity charges, asset costs, housing prices, even rental selling prices, I see declines, not will increase,” he mentioned.

But not everyone agrees. Thomas Hoenig, former president of the Federal Reserve Financial institution of Kansas City, said fees need to have to be higher for lengthier.

“My very own view is you have bought to get the rate up. If inflation is 8%, you require to get the rate up a lot greater,” he advised CNBC’s “Street Symptoms Asia.”

“They need to continue to be there and not back off of that also shortly to in which they reignite inflation, say in the 2nd quarter [of] 2023 or the third quarter,” he added.

— CNBC’s Jihye Lee contributed to this report.

.png#keepProtocol)

.png#keepProtocol)

More Stories

Big Bridge Sways 2024

Top 11 Free 3D Modeling Software in 2024

Shanghai cooperation zone to bolster links between domestic, global players