Medieval mapmakers supposedly wrote “Here Be Dragons” (Hic Sunt Dracones in Latin) to suggest unexplored regions. Nonetheless, there are in point no surviving maps that clearly show this, apart from a solitary 16th century globe. In some way, the phrase remains well acknowledged now and the fantasy lives on, potentially for the reason that it so aptly describes the blend of terror and wonder the unknown brings.

The worldwide economic system is incredibly a great deal in In this article Be Dragons territory. Now that we can vacation and congregate freely without masks and constant hand sanitising, it is tempting to forget how deeply the Covid pandemic proceeds to distort economic exercise specifically and indirectly. Immediately, in the sense that China continue to maintains a coverage of locking down anywhere the virus appears, like complete metropolitan areas. The indirect impact lingers in disrupted offer chains, improved use designs and do the job behaviours, and massive fiscal stimulus in abundant countries (especially the US) and resultant surplus personal savings that continue to sustains shelling out.

The net consequence of this being the most significant worldwide inflation surge in 40 yrs and a charge-of-residing disaster in a lot of sections of the globe. Central financial institutions have responded with intense desire rate hikes, in particular the US Federal Reserve. Better US prices and secure-haven flows have seen the greenback acquire 18% on a trade-weighted basis this year, placing upward stress on inflation and fascination fees in all but a handful of nations, and tightening the screws on borrowers with dollar-denominated financial debt outdoors the US.

On top of all this, the brutal Russian invasion of Ukraine has seen power selling prices go haywire as gas supplies are weaponised. Preventing weather improve has taken a back seat as coal has come to be the go-to alternative. This minute has been aptly described as a polycrisis by economic historian Adam Tooze. Covid has worsened inequality in a lot of international locations, widened pre-existing socio-political divisions and generally manufactured men and women angrier.

There has also been political drop-out, with far more probable to occur.

Terra incognito

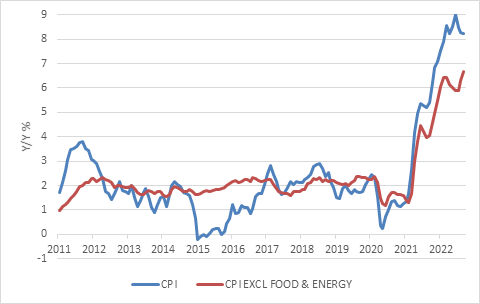

It will take time for a distorted economic climate to locate its harmony, and by implication, for inflation to settle. Final 7 days supplied a reminder of that as the latest US buyer cost index launch showed headline inflation at 8.2% yr-on-12 months in September.

This is a marginally decreased amount compared to the prior three months, but the core inflation charge that excludes foods and gas prices elevated to 6.6%, the best level since 1982 and 2 times the historic typical of the collection considering that 1957. And however it should simplicity in coming months, it is obviously a much way off from the Fed’s 2% focus on.

US shopper value inflation

Source: Refinitiv Datastream

The Fed and other central banking companies are not taking any chances, and this calendar year has viewed more of them climbing charges at the same time than at any time formerly. And although some are issuing warnings that this threats overdoing factors, the International Monetary Fund (IMF) gave address final week in its bi-annual World Financial Outlook, arguing that “front-loaded and aggressive monetary tightening” is warranted to steer clear of inflation anticipations de-anchoring.

In other words and phrases, it sees the hazard of not battling inflation to be better than the threat of overtightening given that it can be painful to dislodge an inflationary psychology when it has become entrenched.

Labour marketplaces in critical developed economies are nevertheless unbalanced, with excess position openings and offer constrained by factors this kind of as prolonged Covid, early retirement, down below-normal migration and switching attitudes to perform (the “Great Resignation”). Tight labour marketplaces can give rise to wage-selling price spirals and unmoored inflation expectations in the view of the IMF and many central banking companies, justifying additional rate will increase.

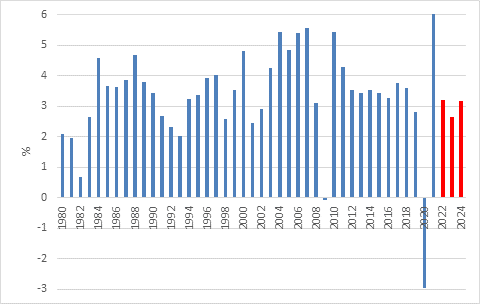

The IMF’s forecasts issue to weaker expansion, elevated inflation, and risks that continue to be “unusually large”.

It expects worldwide growth to sluggish from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023. The typical global expansion due to the fact the IMF started out measuring it in 1980 was 3.6%. World inflation is forecast to rise from 4.7% in 2021 to 8.8% in 2022, declining to 6.5% in 2023.

Genuine global economic development with forecast

Source: Worldwide Financial Fund

In conditions of essential economies, US advancement is anticipated to sluggish markedly from 5.4% final 12 months and 1.6% this calendar year to only 1% in 2023. Presented the fuel disaster, Italy and Germany are forecast to contract future yr, whilst the Uk will stagnate. The IMF can make it crystal clear that these forecasts are much extra possible to be much too optimistic than also pessimistic.

For the first time, the IMF has explicitly warned that China’s worsening residence sector carries substantial spill-about hazards and will weigh on economic expansion. It expects the Chinese economic climate to only grow by 3.2% this calendar year and 4.4% up coming 12 months, perfectly down below Beijing’s 5.5% target and the blistering growth lots of have arrive to assume from the world’s 2nd greatest financial state.

Swift tightening

Central to all the gloomy forecasts is the unparalleled tempo of monetary tightening taking spot at the moment. In some ways it is the mirror image of the stimulus that was unleashed in 2020 the enemy shifting from deflation to inflation in the area of the previous 24 months.

There have been huge interest rate cycles in the past, but in no way have so quite a few central banks hiked so considerably at the similar time.

The entire world economic climate has also hardly ever been so deeply indebted throughout general public and non-public sectors and marketplaces have by no means had to be weaned off central lender-supplied liquidity at pretty these types of a scale as quantitative tightening will get underway.

The chaos in United kingdom bond marketplaces is an example of how rapidly items can unravel in this kind of a tricky ecosystem. The Uk may possibly appear to be like a exclusive scenario of reckless politicians accomplishing irresponsible issues, but there is no lack of reckless politicians in the planet, nor was there a scarcity of reckless economical behaviour prior to this year. The consolation is that there has not been wild excess in standard banking action as perfectly as lending to homes and corporates. These are the clear areas to glimpse (evident only after the 2008 financial disaster) but that doesn’t imply there are not hazards concealed in murkier corners of the economic planet.

The future issue is what the economic effects of these blow-ups will be? When bitcoin or ARK crashed, the financial affect was negligible. But if the gilt market implodes, it will induce significant and prevalent harm, hence the Lender of England stepping in as a market-maker of previous resort by obtaining bonds. It is also noteworthy that the economic sector convulsion was so intense as to drive Uk key minister Liz Truss to sack Kwasi Kwarteng, her Chancellor (finance minister), and roll back again her tax slice package deal in an endeavor to hold her have career. It neatly echoes the remark made 3 a long time back by James Carville, Bill Clinton’s election strategist, that he would like to be reincarnated as the bond current market 1 working day, because it can intimidate all people, even presidents and primary ministers.

At last, in addition to the outlook for inflation, fascination prices and expansion in the subsequent several months, there are also more time-phrase questions.

Which trends are momentary and which kinds are permanent? To what extent does deglobalisation happen as countries hurry to secure important supply chains? How inflationary will this be, and can it stoke conflict? How does the war in Ukraine finish and what does that imply for China’s stance towards Taiwan? A single marker on this uncertain journey came in the earlier handful of days when the US announced huge-ranging limits on exports of laptop or computer chips to China, as perfectly as the equipment utilised to manufacture those chips to stop China from turning into a substantial-tech competitor.

It is no surprise then that bond and fairness markets have offered off greatly in 2022. Probably the only purpose headline fairness indices are not totally down in the dumps but is that some buyers nevertheless cling on to the hope that the Fed and company will “pivot” before long and begin chopping charges. This seems very unlikely, and the optimism is set to be dashed, but it is also normal that when hope has evaporated the lower point in industry cycles is realized.

Marketplaces have also been pretty unstable. For occasion, adhering to the launch of US CPI figures last 7 days, the US inventory market at first fell 2%, then rallied to close higher than 2%, only the fifth time it has finished so in the earlier a few a long time.

Uncharted waters

Touring in these uncharted waters, do we have nearly anything to guidebook us? The map is not the territory, as philosophers say (or employed to say prior to Google Earth and related companies), considering the fact that the map will have to abstract from truth. A map with each solitary detail would be far too significant to be helpful, but even a very simple map can enable significantly throughout a extensive terrain.

There are simple investment principles that still implement even in this polycrisis. We cannot predict the long run – even the mighty IMF with its army of PhD economists will get its forecasts mistaken significantly of the time – but we can just take a number of classes from the previous.

A single is that markets are inclined to be pretty good at pricing in regarded undesirable news. It is the major surprises that lead to massive moves.

We really do not know if there are major surprises in advance, but markets undoubtedly currently reflect the financial weak point almost everybody understands is coming. Following all, world-wide equities are down 25% in dollar terms year to date.

There are pockets of the world fairness universe that already trade at recessionary ranges, together with South Africa and numerous other emerging marketplaces, US mid and tiny caps, European industrials and so on. The mega-cap technologies organizations make the broader US current market continue to seem reasonably pricey.

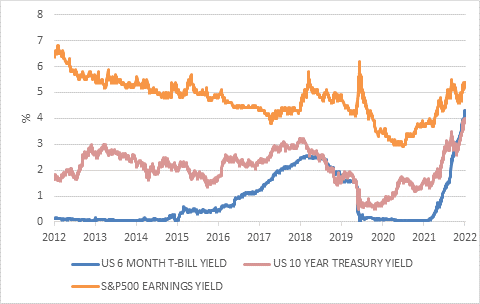

From TINA to TARA

Source: Refinitiv Datastream

Meanwhile, world-wide bond and funds yields are also at ranges final observed a ten years or a lot more in the past.

For the very first time given that the 2008 crisis, equities are no lengthier the only place to be overseas.

We’ve moved from a There is No Alternate (TINA) planet (i.e., no option to equities) to a There Are Fair Choices (TARA) entire world (with the solutions to be located in the bond marketplace).

In South Africa, bond yields have been incredibly elevated because the sector (not the scores companies) downgraded the federal government to junk position in 2015.

Bonds keep on to present eye-catching true yields provided the bettering fiscal condition and the Reserve Bank’s severe motivation to preserving inflation in just its concentrate on.

Record tells us that when marketplaces offer off, future returns make improvements to even as existing returns fall. Set in different ways, industry crashes make long term investors richer when producing present traders poorer.

Existing buyers must keep away from building on their own even poorer by locking in losses and lacking the upside. This is hard when uncertainty and volatility are large and glimpse set to keep on being large for some time, and generally navigating their possess psychological reaction is investors’ major challenge.

Izak Odendaal is an investment decision strategist at Old Mutual Prosperity

.png#keepProtocol)

.png#keepProtocol)

More Stories

Big Bridge Sways 2024

Top 11 Free 3D Modeling Software in 2024

Shanghai cooperation zone to bolster links between domestic, global players