Table of Contents

UGI Corporation headquarters in King of Prussia, Pennsylvania, USA. JHVEPhoto

Why does UGI make a good fit for my portfolio?

UGI Corporation (NYSE:UGI) is a holding company. They distribute and market energy products and services through their subsidiaries. UGI Utilities, Inc. provides regulated natural gas distribution and electric utility services in the states of Pennsylvania and Maryland. Mountaineer Gas Company is an indirect, wholly owned subsidiary of UGI that does regulated natural gas distribution in West Virginia. UGI Energy Services, LLC conducts UGI’s midstream natural gas and electric generation business, owns related assets in Pennsylvania, and serves customers across Pennsylvania, New Jersey, Delaware, New York, Ohio, Maryland, Massachusetts, Virginia, North Carolina, South Carolina, Rhode Island, California, and the District of Columbia. UGI International distributes LPG in 17 countries in western and central Europe, operating under six distinct brands with market leadership in their respective areas of operation. As per their investor resources, UGI International is also in the process of exiting the non-core European energy marketing business located in France, Belgium, and the Netherlands. They are also the nation’s largest retail propane marketer, doing business in all 50 states with approximately 1,400 locations, and conduct business principally through its subsidiary, AmeriGas Propane, L.P.

Their long-term goal is to grow business, increase cash flow, and create value for shareholders with a three-point strategy.

UGI’s Goal Strategy (UGI’s website)

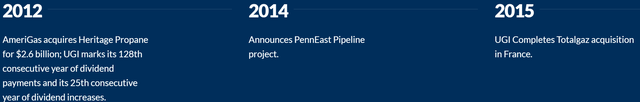

UGI boasts a rich history as an organization spanning more than 137 years. Their goal and strategy made UGI the organization we see today. The execution of their strategy in the last decade includes:

UGI-History-2012-2018 (UGI website) UGI-History-2019-2023 (UGI Website)

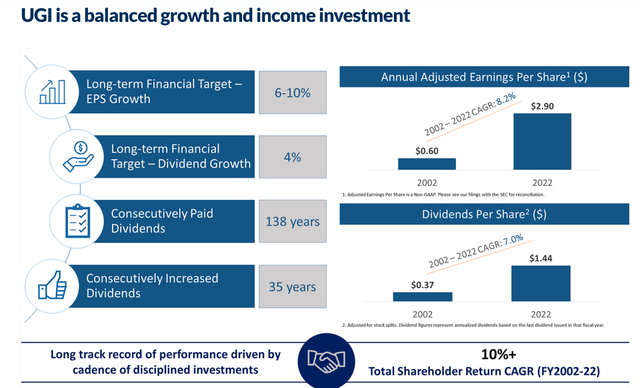

UGI’s “common stock is a balanced growth and income investment. UGI Corporation has paid common dividends for more than 137 consecutive years.” (Source: About UGI | UGI Corporation)

UGI’s business goal, strategy, and 137+ year history make UGI a good choice for my portfolio.

UGI is a dividend aristocrat

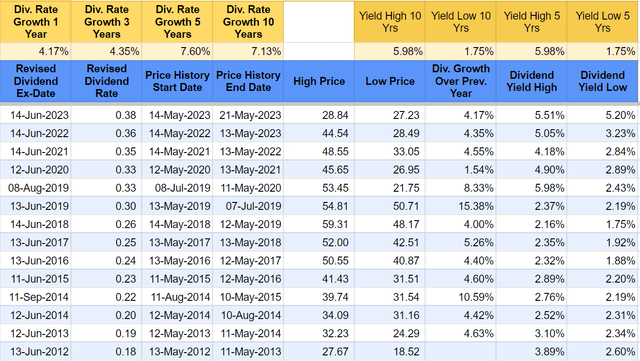

UGI has paid 137 consecutive years of dividends, increasing the dividends for over 35 consecutive years. The 36th dividend increase has been declared, increasing from $0.36 per quarter to $0.375 per quarter, and will be paid to shareholders on July 1, 2023, with a dividend ex-date of June 14, 2023. The dividends are usually paid on the 1st working day of January, April, July, and October of each year. The last increase represents a 4.2% increase over the earlier one. The dividend history, ex-date, the market price range related to the dividend rate periods, and the highest and lowest yields in those periods are listed below:

UGI dividend history in previous 10 years (Author compiled data)

In the last 10 years, UGI has yielded a high of 6% during the pandemic panic crash. The yield at the current market price is around 5.25%, which appears to be a good reason to buy this stock now to start my initial position in UGI.

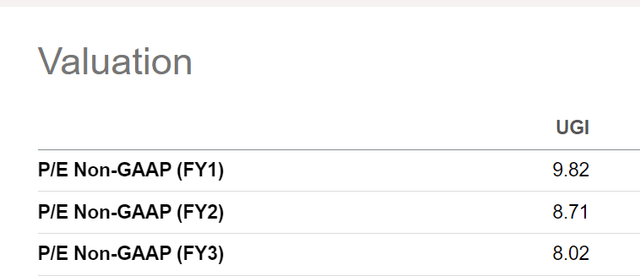

Valuations:

I generally value the stock in different ways as part of my buy-range guidance.

1) The 10-year historical highest dividend yield range in one such method, as shown above, a price of $27.50 is near the yield high. At $27.50, UGI will yield 5.45%. The recent pandemic-type crash should yield 6%, or a price equivalent of $25. This price range of $25 to $27.50 seems like a fair price range where a buy-and-hold investor will gain in the long run, both in terms of value and in terms of income from yield.

2) DDM (Dividend Discount Model) is a method of valuing a stock with the sum of future dividends discounted at a desired rate. I will use 10% (my expected market returns) as the discount rate. To compute future dividends, the dividend growth rate will also be input as an element for calculation. UGI has grown the dividend at an annual rate of 7.13% in the last ten years, 7.60% in the last five years, 4.35% in the last three years, and 4.17% in the last one year. The growth rate seems to be decreasing. The company is paying out a $1.50 dividend, while its current-year estimated earnings are $2.85 per share. This is a comfortable payout ratio. The estimated earnings per share in 2024 going forward are $3.22. While these are estimates, the past-year payout ratio is just 50%. The payout ratio indicates the ability of UGI to continue to reward shareholders going forward. If I use 4% as a safe future dividend growth rate, the DDM model indicates a fair price of $26 for UGI. If the last-year dividend growth rate of 4.17% is used, the DDM model indicates $26.80 as a fair price. This is more or less in line with the average price projection in (1) above.

3) Yet another way I estimate a fair value is based on the sum of discounted dividends for a number of future years. Here, the discount rate used differs from the discount rate used in the DDM model. This is a discount to determine the current money value of future dividends. Hence, I will use a fair average annual inflation rate, which I estimate at 5%, though the FED aims for 2% to 2.5% inflation as a goal and the actual inflation is higher for now. The sum of the next 25 years dividends growing at 4.17% for UGI will amount to $32.52. The sum of the next 20 years dividends growing at 4.17% will amount to $26.52. Thus, we can fairly assume that the income from the next twenty-year dividends, discounted at 5%, will give back what we have paid today as a buy price.

4) UGI is a utility. Utilities tend to have a fair PE of 15 in terms of valuation. UGI is not exposed to sharp variations in commodity prices. As a strategy:

Distribution and services business, marketing volume hedged back-to-back, LPG customer volume hedged as service offering:

“The distribution charge includes all of the costs UGI incurs to own, operate, and maintain its pipeline systems, which deliver natural gas to customers’ homes. The distribution charge also includes the costs associated with providing customer and emergency response services. The commodity charge reflects the actual cost of the natural gas a customer consumes. All costs for the gas customers consume is passed along to them with no markup by UGI. In other words, UGI purchases the natural gas supply from producers and resells it to the customer at the same price. UGI makes no profit on the sale of the natural gas customers consume, and consumers have the right to choose the company that generates their natural gas.”

-Source: UGI website

UGI’s PE at below 10 looks attractive to me in terms of PE valuation.

5) The price to book is in the range of 1.16 at the current market price. Book Value per share is $24.07

Credit Ratings:

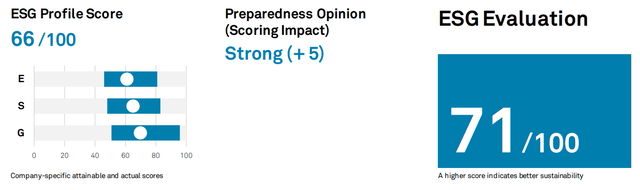

AmeriGas LP has a Ba3 rating from Moody’s and a BB- rating from Fitch. UGI Energy Services has a Ba3 rating from Moody’s. UGI International has a Ba1 rating from Moody’s and a BB+ rating from Fitch. UGI Utilities has an A3 rating from Moody’s and an A rating from S&P. UGI has no debt at the corporate level, giving it optional additional borrowing ability if needed. These indicate an investment-grade status for UGI overall. UGI earned a 71/100 ESG score in S&P Global Ratings. A score of 70 or above is considered excellent.

MSCI upgraded the ESG ratings to AAA in January 2023.

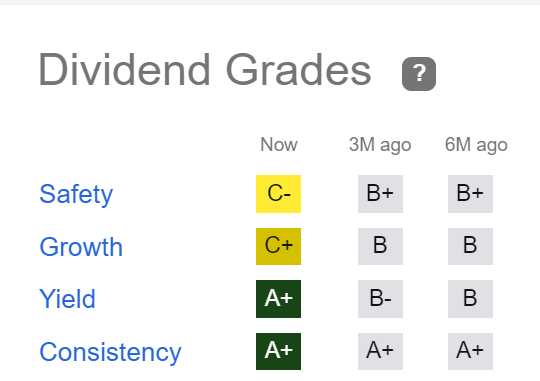

Dividend Grading by Seeking Alpha:

Seeking Alpha has assigned the following dividend grades to UGI.

Dividend Grades – SA (seekingalpha.com)

The reasons that makes UGI a good investment can be summed up in the following clip from UGI’s investor site:

Reasons to Buy UGI (UGI Investors relation site)

The reason to buy now can be made with the price being attractive with a dividend yield greater than 5% at current prices.

Before initiating an investment, the following negative reasons should also be considered:

1. Volatile commodity prices could reduce the margins for handling its products.

2. Unfavorable weather conditions during the winter and summer seasons can lower the demand and hence the operations.

3. The company plans to expand its midstream business, which involves the construction of new pipelines. Such activities expose UGI to several regulatory and environmental uncertainties that are beyond the company’s control. The projects might get delayed, causing cost escalations and reducing profitability.

4. The interest rate hikes and the inflation of costs can reduce profitability going forward.

But every business has its risks. UGI’s history makes me take the side of pluses over minuses on this occasion, and when the prices are low, I add them to my investment portfolio. The current market prices are down for such reasons. But the natural wisdom to limit one’s investment relative to portfolio size should save us just in case the decision to invest goes wrong for any reason. I will limit my exposure to a maximum of 2% of my portfolio size.

My Disclosure:

I intend to buy 100 shares of UGI for an initial position, while I would consider 400 to 500 shares as my total portfolio limit for the long-term intended hold. The aim is to limit the investment to a maximum of 2% of my long-term total portfolio size. I will also temporarily hold a maximum of 1000 shares in my portfolio, which will include the trade bucket quantity as short-term holds to generate cash gains in day trading activities. The additional buys and sells with day trade gains intention is to let the readers know that I will be both buying and selling the shares frequently while also building my portfolio position for the long term. UGI’s net position in my portfolio will always be long. I never sell short. Please do your diligence before investing.

More Stories

Essential tips for new website owners on how to successfully manage a shared hosting account

How Much Time Does It Take To Create a Website?

Employee Appreciation Day: How to build a culture of year-round recognition