Table of Contents

Intuit QuickBooks is the most well-known accounting software in the world — but it has certain drawbacks, including a very high starting price. As a result, many businesses contemplate switching to an alternative such as Sage Accounting, which is another popular accounting software for small businesses.

To help you decide which one is right for your needs, we’ll compare Sage Business Cloud Accounting and QuickBooks Online in this review.

Jump to:

What is Sage?

Sage makes accounting and business management software for businesses of all sizes. Sage technically offers three separate accounting products: the Sage Business Cloud Accounting service, the Sage 50 “cloud-enabled” desktop product and the Sage Intacct enterprise accounting software. For the purposes of this review, we will be comparing Sage Business Cloud Accounting to QuickBooks Online to provide the most accurate comparison.

What is QuickBooks?

Intuit QuickBooks is a business accounting software company that provides bookkeeping software and other accounting and finance solutions, including payroll. Similar to Sage, QuickBooks also offers multiple accounting products: QuickBooks Online and QuickBooks Desktop. It also offers an optional payroll add-on, called QuickBooks Payroll. While the payroll tool is beyond the scope of this comparison, you can learn more about it in our QuickBooks Payroll review.

Sage vs. QuickBooks: Comparison table

| Features | Sage | QuickBooks |

|---|---|---|

| Starting price | $10/mo. | $30/mo. |

| Invoicing | Yes | Yes |

| Accounts payable and receivable | Yes | Yes |

| Inventory management | Yes | Yes |

| Reporting templates | 20+ | 50+ |

1

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

3

Justworks

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

Sage vs. QuickBooks: Pricing

Sage pricing

Sage Business Cloud Accounting has only two plans:

- Sage Accounting Start: Costs $10 per month and includes access for one user.

- Sage Accounting: Costs $25 per month and supports unlimited users.

Sage typically offers a 30-day free trial. It also has frequent sales that apply only to its more advanced plan. Discounts can be as deep as 70% for six months, which lowers the annual Sage Accounting price by more than $100.

QuickBooks pricing

QuickBooks Online offers four different pricing tiers to choose from:

- QuickBooks Simple Start: Costs $30 per month with access for one user.

- QuickBooks Essentials: Costs $55 per month with access for up to three users.

- QuickBooks Plus: Costs $85 per month with access for up to five users.

- QuickBooks Advanced: Costs $200 per month with access for up to 25 users.

As a first-time QuickBooks customer, you can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

Sage vs. QuickBooks: Feature comparison

Invoice management

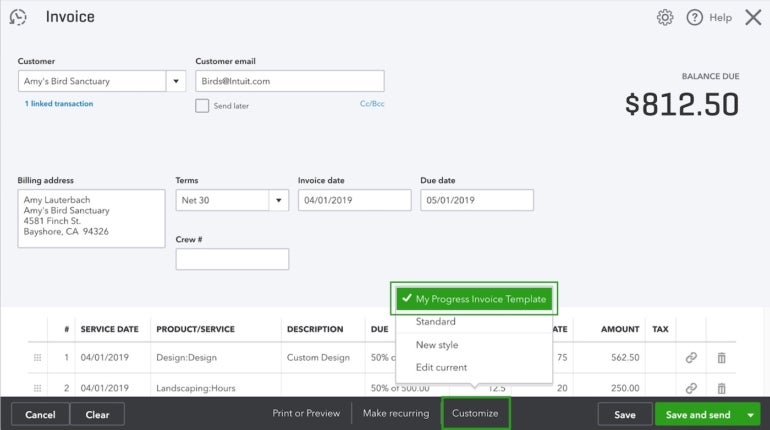

In QuickBooks, you can create custom invoices (Figure A) with logos and colors that match your business branding. You can set up recurring invoices to auto-send every day, week, month or year so you don’t have to generate them from scratch. Once you’ve submitted the invoice, QuickBooks tracks when your customers have viewed, paid and deposited them.

Figure A

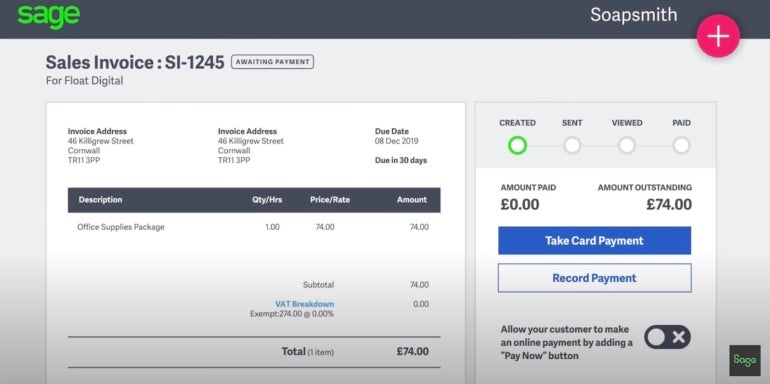

Sage Accounting also allows you to create customizable invoices (Figure B) and set up recurring invoices. You can also convert quotes to invoices with just one click and nudge slow-paying customers with reminders about outstanding invoices as well. Plus, Sage Accounting connects to your bank and other systems so everything flows together seamlessly.

Figure B

Bill payments

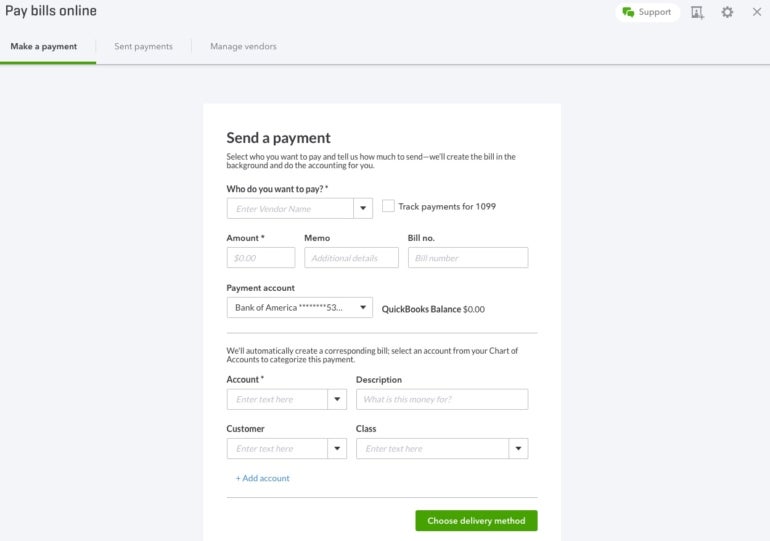

QuickBooks offers three solutions for bill pay: QuickBooks Bill Pay, Bill Pay powered by Melio and Bill Pay powered by Bill.com. Depending on which one you have, you can schedule full and partial bill payments (Figure C) and view or edit your vendor’s payment information. Your vendors will be notified when you schedule a bill payment so they know when the money is coming in.

Figure C

Sage’s bill payment functions lets you pay an invoice or vendor directly, enter prepayments and update job cost expenses. Connected banking and automated data capture significantly reduce paperwork and busy work and makes it easy to flag a dispute or create a credit note. Cash flow reports let you see what money is going in and out at a glance.

Inventory tracking

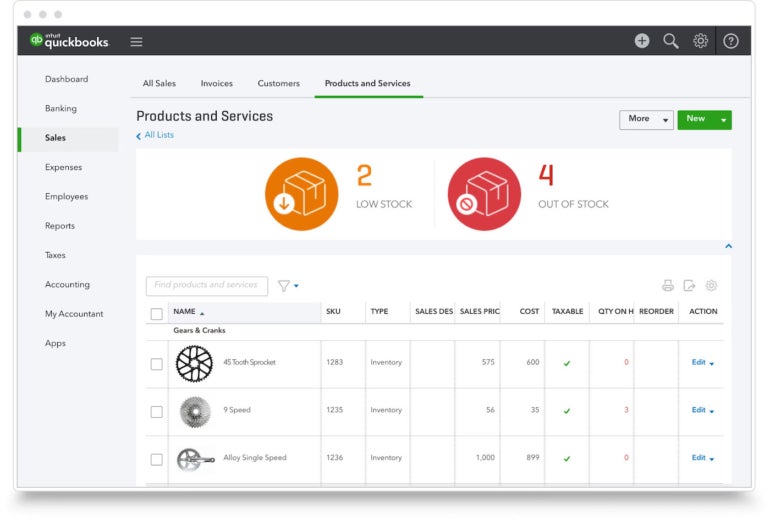

The QuickBooks Plus and Advanced plans offer inventory tracking (Figure D) so you can see what items and materials you have on time. QuickBooks will also alert you when it’s time to restock and offer analytic insights on what you buy and sell. You can even add services or non-inventory items so that everything is centralized in one system.

Figure D

Sage’s inventory management tool offers both real-time visibility and forecasting so you can see the status of your stock both now and in the future. And with barcoding, you can reduce how long it takes to track inventory, while reporting helps you make better business decisions about which products and quantities to stock.

Business reporting

QuickBooks is known for its excellent reports, and even the entry-level plan comes with more than 50 report templates for you to use. The dashboard contains all the high-level stats you’ll want to check on a regular basis, while individual reports let you drill down deep on specific topics. Reports can be customized to show exactly the data you need, and you can keep your accountant and other stakeholders up to speed with email updates.

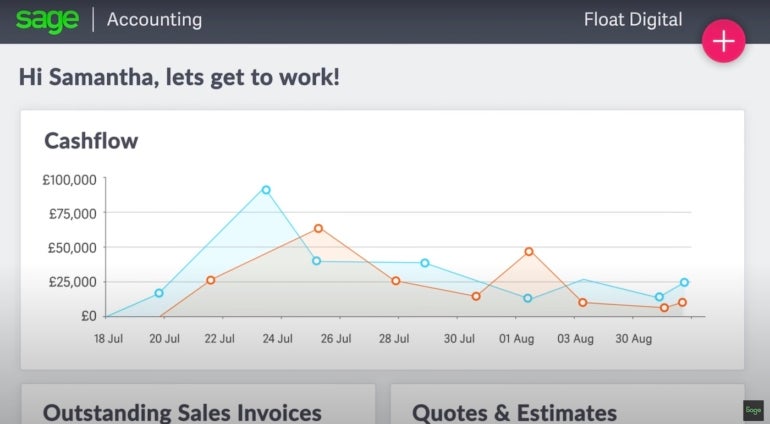

Sage’s dashboard (Figure E) also puts essential information, such as cash flow and balance sheet data, all in one easy to read place. Quickly share reports and summaries with your accountant or team to keep them up to date. Sage Business Accounting includes about 20 pre-built report templates, which is a nice number but nowhere near the same amount as QuickBooks.

Figure E

Sage pros and cons

Pros of Sage

- More affordable than QuickBooks.

- Support for many different currencies.

- Excellent inventory tracking.

- Unlimited users on Sage Accounting plan.

Cons of Sage

- No native mileage or time tracking features.

- Could use more integrations.

- Must upgrade to Sage Account and get AutoEntry add-on for receipt capture.

QuickBooks pros and cons

Pros of QuickBooks

- More than 750 integrations.

- 50+ reports on the entry-level plan alone.

- Very easy to share information with your accountant.

- Receipt tracking available on all plans.

Cons of QuickBooks

- More expensive than Sage Accounting and most competitors.

- Each plan limits the number of users.

- Learning curve can be frustrating.

Methodology

To compare Sage Business Cloud Accounting and QuickBooks online, we considered features such as invoicing, accounts payable and receivable, inventory tracking and reporting templates. We also weighed factors such as pricing, ease of use and customer support accessibility. While writing this review, we consulted product documentation, read user reviews and viewed demo videos.

Should your organization use Sage or QuickBooks?

Both Sage and QuickBooks are some of the best accounting software options on the market, but each software has its own list of advantages and drawbacks.

If you are a small business looking for a budget-conscious option — and don’t need advanced features like time and mileage tracking — then Sage Accounting is the right choice for you. We also like that Sage offers unlimited users on all plans, so you won’t be forced to upgrade to a more expensive plan just because you need more seats. You also get to take advantage of the free trial and whatever introductory offer is running, whereas QuickBooks makes you choose one or the other.

If you do need that more advanced functionality, then QuickBooks is a better choice thanks to its more comprehensive feature set. However, you have to be willing to pay for those additional features, especially if you need a lot of users to access the software. QuickBooks’ most expensive plan is eight times the cost of Sage’s most expensive plan, and the QuickBooks Advanced plan still caps you at 25 users.

Still not convinced that either Sage Accounting or QuickBooks is right for your needs? Check out our list of the best accounting software for small businesses to see what other options are out there.

1

QuickBooks

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

2

Paycor

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

3

Justworks

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

More Stories

‘The Forest Must Stay!’ Treetop Protest Erupts At Tesla’s Berlin Gigafactory As Activists Try To Thwart Expansion – Tesla (NASDAQ:TSLA)

GamerSafer acquires Minecraft-focused Minehut server community

New York Appeals Court allows Trump, sons to continue running business, denies request to delay payment