Table of Contents

iprogressman/iStock via Getty Images

Dear readers/followers,

I’ve published two articles on Brandywine Realty Trust (NYSE:BDN) this year – one in February at $6.74 per share and one in April at $3.84 per share, highlighting the fact that the REIT was trading deeply below replacement costs and that the double-digit dividend remained well covered at the time.

I bought into the stock in what I considered a medium-term swing trade and added heavily upon publishing my second article. Since then, the stock price has returned to my break-even of just above $5 per share, and I have decided to close my position.

Today, I discuss my reasons for doing so.

Overview

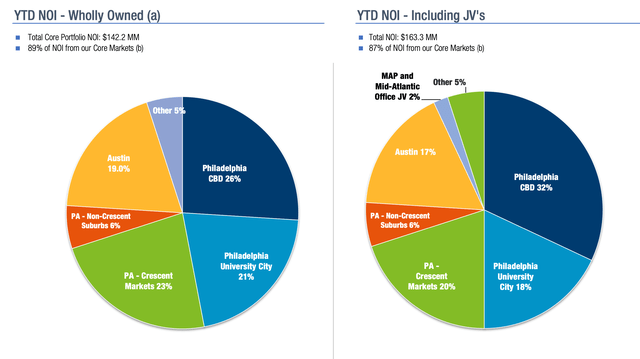

Brandywine is an office REIT with a heavy exposure to the Philadelphia market, where 76% of the company’s NOI is generated. The remaining portion of NOI comes from their properties located primarily in Austin, Texas.

Their focus is on A-Class properties in good locations, but their portfolio is still somewhat burdened by several old B/C-Class properties in the suburbs of Philadelphia, some of which have very low occupancy of around 50%.

BDN Presentation

My reasons for selling

With offices now facing the perfect storm and many tenants choosing to downsize due to WFH, I have made a firm decision to only invest in the best of breed, meaning high quality (young) space located in prime locations.

I believe that during this crisis, as tenants consolidate their space, the best office space will do very well, while average and below-average space will struggle to survive. On this front, I don’t see BDN as very well positioned, which makes for the first reason to sell.

The REIT owns what you would consider as traditional office space which is leased predominantly to tenants in business, finance, legal and other administrative sectors. This makes the REIT’s occupancy quite susceptible to work from home.

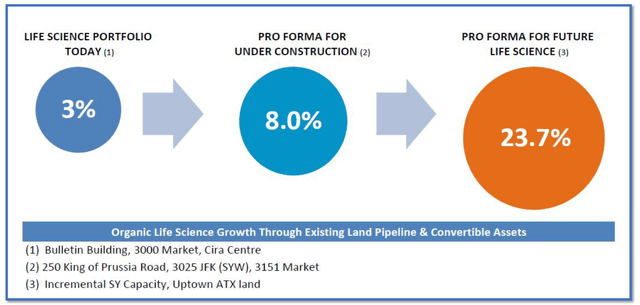

This is why management has been pushing hard to increase their exposure to life sciences from only 3-4% currently to 20% over the next 5 years.

And they are putting their money where their mouth is as most of their space currently under construction is dedicated for life sciences and will increase the proportion of this WFH-resistant sector to 8%. While the move to life sciences might pay off in the long-term, it will no doubt put a lot of strain of cash flow in the near-term.

BDN Presentation

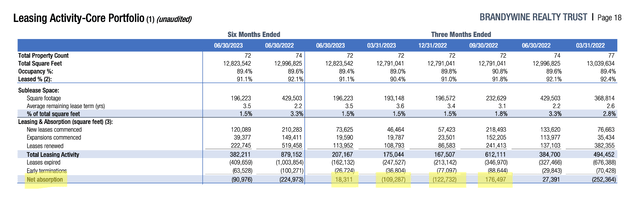

The single most important metric I’ve been tracking for BDN has been their net absorption. This is the difference between the amount of space that becomes available in a given quarter (because of lease expirations) and the amount of space that is leased. A negative net absorption leads to a decline in occupancy and vice versa.

Unfortunately for Brandywine, their leasing hasn’t been able to keep up with lease expirations over the past year, which has resulted in a drop in occupancy from 90.8% to 89.4%. And although net absorption has been slightly positive in Q2 2023, it’s not enough to move the needle.

BDN Presentation

BDN’s recent struggle to attract new tenants leads me to reason number two for selling the stock. The thing is that to keep occupancy reasonably high, the REIT will have to do one of two things: (1) lower rents or (2) provide higher incentives to new tenants in the form of longer rent-free periods or higher fit-out contributions. We are already seeing this in action with very low rent spreads on their new leases. This will inevitably reduce the REIT’s cash flow going forward.

Combined with a capital intensive development pipeline and several very old B/C-Class properties with occupancy as low as 50% which are in desperate need of significant CAPEX for refurbishment, I expect that the company’s cash flow and consequently FFO will contract over the next couple of quarters and years.

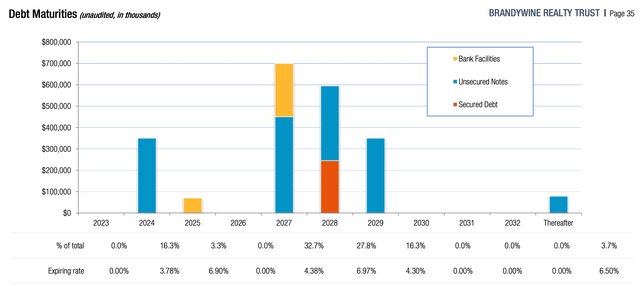

A drop in FFO could potentially put the now $0.19 quarterly dividend in jeopardy. The dividend remains covered for now with an FFO payout ratio of 65% and a CAD payout ratio of 84%. But the stock market clearly isn’t giving the stock any credit for paying a nearly 14% dividend. That’s why I think that at some point, management will make the prudent decision to cut the dividend to preserve liquidity and lower their high leverage of 7.4x EBITDA, especially in light of the approaching $350 Million debt maturity in 2024. A cut almost always leads to further downside and makes for a third reason to sell.

BDN Presentation

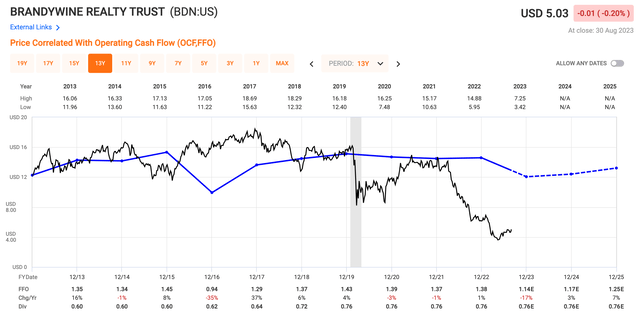

On the valuation front, little has changed for BDN. The stock continues to trade at a low multiple of 4x FFO, an implied cap rate of around 10% and deeply below replacement costs.

FAST Graphs

All of these indicate that there is indeed upside if things go well, but I view this investment as quite speculative and potentially risky if occupancy and FFO continues to decline quarter-over-quarter. Moreover, the stock doesn’t fulfil my criteria for high quality real estate, as some of their properties are old and poorly located.

For these reasons, I have decided to sell my position in BDN and rate the stock a HOLD here at $5 per share.

As for other office REIT, I continue to hold small swing positions in the best of breed office REITs. These include Boston Properties (BXP), Kilroy Realty Corporation (KRC) and Highwoods Properties (HIW). I have no plans of adding office exposure to my core long-term portfolio at this time.

More Stories

The Key to Boosting Retention

Kim Jong Un Unveils Ambitious ‘Regional Development Policy’ To Modernize Rural North Korea Amid Food Shortages

Industry Leader Revolutionizes Business Financing Through Credit Stacking