With the business enterprise possibly at an important milestone, we considered we might just take a closer search at CC Neuberger Principal Holdings II’s (NYSE:PRPB) foreseeable future potential customers. CC Neuberger Principal Holdings II does not have sizeable functions. The US$1.1b marketplace-cap organization posted a reduction in its most modern economic year of US$2.7m and a most up-to-date trailing-twelve-month decline of US$13m leading to an even broader hole concerning reduction and breakeven. Many buyers are pondering about the charge at which CC Neuberger Principal Holdings II will turn a revenue, with the significant query currently being “when will the firm breakeven?” Underneath we will offer a higher-level summary of the marketplace analysts’ anticipations for the firm.

View our latest assessment for CC Neuberger Principal Holdings II

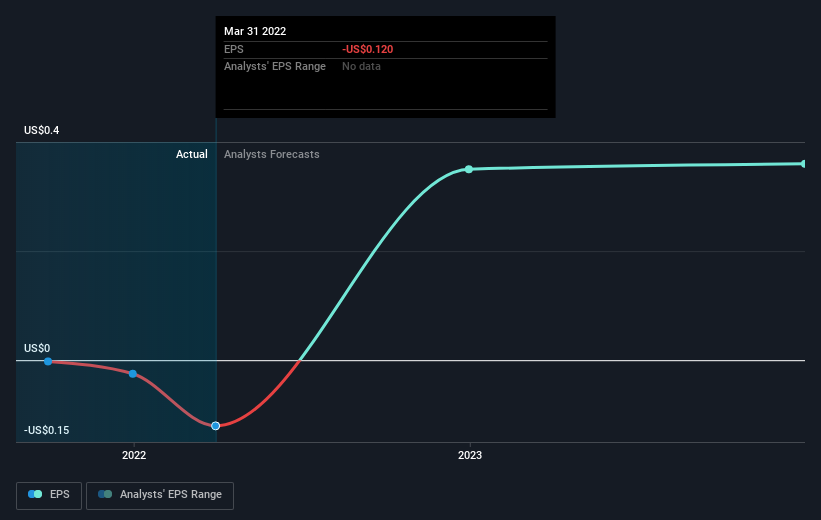

Expectations from some of the American Money Markets analysts is that CC Neuberger Principal Holdings II is on the verge of breakeven. They be expecting the company to write-up a ultimate decline in 2021, prior to turning a profit of US$97m in 2022. Consequently, the enterprise is envisioned to breakeven approximately 12 months from now or much less. We calculated the amount at which the company need to develop to satisfy the consensus forecasts predicting breakeven inside 12 months. It turns out an average annual expansion fee of 101% is envisioned, which is exceptionally buoyant. If this level turns out to be also aggressive, the organization might grow to be successful much afterwards than analysts predict.

We are not likely to go through enterprise-certain developments for CC Neuberger Principal Holdings II given that this is a substantial-amount summary, even though, consider into account that by and massive a high expansion amount is not out of the common, specially when a business is in a period of time of financial investment.

One particular factor we would like to provide into gentle with CC Neuberger Principal Holdings II is it at present has negative equity on its harmony sheet. This can occasionally crop up from accounting solutions employed to offer with gathered losses from prior several years, which are considered as liabilities carried forward right until it cancels out in the upcoming. These losses are inclined to manifest only on paper, on the other hand, in other situations it can be forewarning.

Future Actions:

This posting is not supposed to be a complete analysis on CC Neuberger Principal Holdings II, so if you are interested in comprehending the firm at a further stage, get a seem at CC Neuberger Principal Holdings II’s corporation webpage on Merely Wall St. We’ve also compiled a list of crucial variables you should really seem at:

-

Historical Monitor Record: What has CC Neuberger Principal Holdings II’s functionality been like more than the past? Go into additional detail in the past keep track of report analysis and choose a appear at the free of charge visible representations of our assessment for additional clarity.

-

Administration Workforce: An professional administration team on the helm improves our assurance in the enterprise – get a search at who sits on CC Neuberger Principal Holdings II’s board and the CEO’s track record.

-

Other Substantial-Executing Shares: Are there other stocks that offer improved prospects with verified track documents? Investigate our no cost checklist of these terrific shares listed here.

Have feed-back on this post? Anxious about the material? Get in contact with us straight. Alternatively, email editorial-group (at) simplywallst.com.

This article by Simply Wall St is standard in mother nature. We offer commentary based on historic details and analyst forecasts only applying an unbiased methodology and our articles are not supposed to be economic assistance. It does not represent a recommendation to acquire or promote any stock, and does not choose account of your targets, or your economic situation. We goal to deliver you very long-phrase concentrated investigation pushed by elementary facts. Note that our investigation could not variable in the hottest price-sensitive company announcements or qualitative product. Simply Wall St has no position in any shares stated.

.png#keepProtocol)

.png#keepProtocol)

More Stories

‘The Forest Must Stay!’ Treetop Protest Erupts At Tesla’s Berlin Gigafactory As Activists Try To Thwart Expansion – Tesla (NASDAQ:TSLA)

GamerSafer acquires Minecraft-focused Minehut server community

New York Appeals Court allows Trump, sons to continue running business, denies request to delay payment