Table of Contents

Famous fund manager Li Lu (who Charlie Munger backed) at the time stated, ‘The major financial investment hazard is not the volatility of charges, but whether you will undergo a everlasting reduction of cash.’ So it appears the smart revenue is aware that financial debt – which is typically associated in bankruptcies – is a quite important component, when you evaluate how risky a corporation is. Importantly, Macmahon Holdings Confined (ASX:MAH) does have personal debt. But the much more crucial concern is: how substantially risk is that financial debt making?

When Is Personal debt Dangerous?

Normally talking, debt only becomes a authentic dilemma when a business cannot quickly fork out it off, possibly by raising capital or with its have hard cash circulation. In the worst situation state of affairs, a corporation can go bankrupt if it are not able to fork out its collectors. Nonetheless, a much more popular (but nonetheless unpleasant) circumstance is that it has to increase new fairness money at a small rate, so permanently diluting shareholders. Owning explained that, the most popular predicament is where by a business manages its debt reasonably well – and to its personal edge. The to start with move when considering a firm’s personal debt stages is to look at its hard cash and debt with each other.

Look at out our newest analysis for Macmahon Holdings

What Is Macmahon Holdings’s Credit card debt?

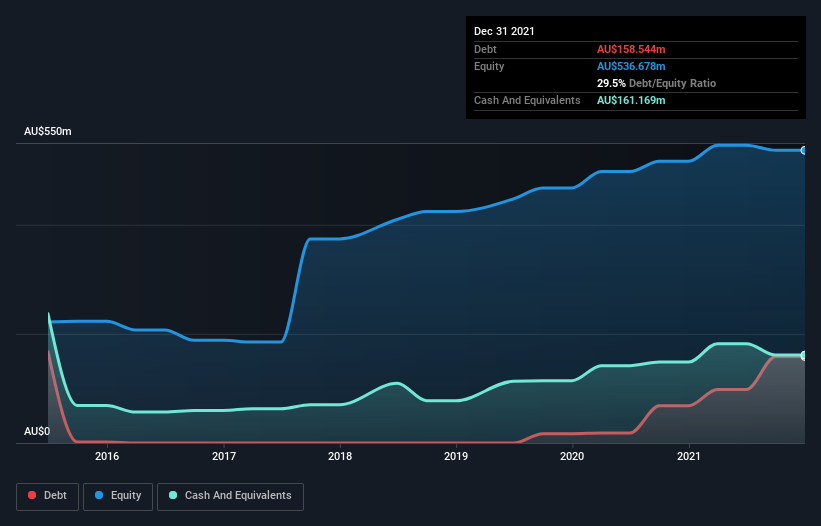

The image below, which you can simply click on for increased detail, displays that at December 2021 Macmahon Holdings experienced personal debt of AU$158.5m, up from AU$68.3m in a person calendar year. Nevertheless, it does have AU$161.2m in cash offsetting this, top to net money of AU$2.63m.

A Appear At Macmahon Holdings’ Liabilities

We can see from the most new equilibrium sheet that Macmahon Holdings experienced liabilities of AU$408.6m slipping because of in a 12 months, and liabilities of AU$305.7m owing outside of that. Offsetting this, it experienced AU$161.2m in dollars and AU$278.9m in receivables that were being thanks inside of 12 months. So its liabilities outweigh the sum of its funds and (around-term) receivables by AU$274.2m.

This deficit is sizeable relative to its marketplace capitalization of AU$336.2m, so it does suggest shareholders should really keep an eye on Macmahon Holdings’ use of financial debt. This implies shareholders would be seriously diluted if the firm essential to shore up its harmony sheet in a hurry. When it does have liabilities worth noting, Macmahon Holdings also has more income than debt, so we are rather self-assured it can handle its credit card debt properly.

Unfortunately, Macmahon Holdings’s EBIT truly dropped 4.5% in the very last 12 months. If earnings go on on that drop then running that personal debt will be tough like providing very hot soup on a unicycle. When analysing personal debt concentrations, the harmony sheet is the obvious position to commence. But ultimately the upcoming profitability of the business will make your mind up if Macmahon Holdings can strengthen its stability sheet above time. So if you are concentrated on the potential you can check out this totally free report showing analyst gain forecasts.

At last, a firm can only pay back off credit card debt with chilly tricky hard cash, not accounting earnings. Macmahon Holdings could have internet income on the balance sheet, but it is continue to attention-grabbing to look at how well the business enterprise converts its earnings in advance of curiosity and tax (EBIT) to free hard cash move, for the reason that that will impact the two its need to have for, and its capability to take care of credit card debt. More than the most the latest a few years, Macmahon Holdings recorded cost-free dollars move truly worth 77% of its EBIT, which is about ordinary, presented cost-free funds movement excludes curiosity and tax. This cost-free money flow places the organization in a excellent position to pay out down credit card debt, when acceptable.

Summing up

While Macmahon Holdings’s equilibrium sheet isn’t really especially robust, thanks to the total liabilities, it is obviously optimistic to see that it has internet funds of AU$2.63m. And it impressed us with free hard cash flow of AU$41m, getting 77% of its EBIT. So we do not have any difficulty with Macmahon Holdings’s use of debt. The balance sheet is plainly the place to focus on when you are analysing credit card debt. However, not all investment chance resides in the equilibrium sheet – considerably from it. Situation in place: We have spotted 2 warning signals for Macmahon Holdings you really should be conscious of.

If you might be intrigued in investing in corporations that can increase income without the load of financial debt, then verify out this free checklist of escalating businesses that have net cash on the harmony sheet.

Have feed-back on this article? Concerned about the content? Get in contact with us specifically. Alternatively, e-mail editorial-group (at) simplywallst.com.

This article by Merely Wall St is normal in character. We provide commentary primarily based on historical data and analyst forecasts only making use of an unbiased methodology and our article content are not meant to be monetary advice. It does not represent a advice to buy or market any stock, and does not take account of your objectives, or your financial problem. We goal to deliver you extensive-phrase centered assessment driven by basic information. Notice that our assessment may well not aspect in the most current selling price-delicate business bulletins or qualitative substance. Simply just Wall St has no situation in any stocks pointed out.

More Stories

‘The Forest Must Stay!’ Treetop Protest Erupts At Tesla’s Berlin Gigafactory As Activists Try To Thwart Expansion – Tesla (NASDAQ:TSLA)

GamerSafer acquires Minecraft-focused Minehut server community

New York Appeals Court allows Trump, sons to continue running business, denies request to delay payment