Table of Contents

When you will need income as a Trader or Serious Estate Developer? You will surely use a single of these Financial loan forms. Business people also need to know and digest what the 4 distinct Financial loan sorts are when Investing and employing Debt cars or Borrowed funds.

Kansas Metropolis Private Financial loans, Kc Home loans and Kansas Missouri Financing Readily available.

Speak to Me Right here NOW!

What you require to know?

What Is a Balloon Payment Financial loan

A balloon payment mortgage is a home loan or personal loan in which does not totally amortize around the time period of the note, therefore leaving a equilibrium because of at maturity. The ultimate payment is termed a balloon payment mainly because of its big dimension. Balloon payment mortgages are a lot more frequent in professional genuine estate than in household genuine estate.

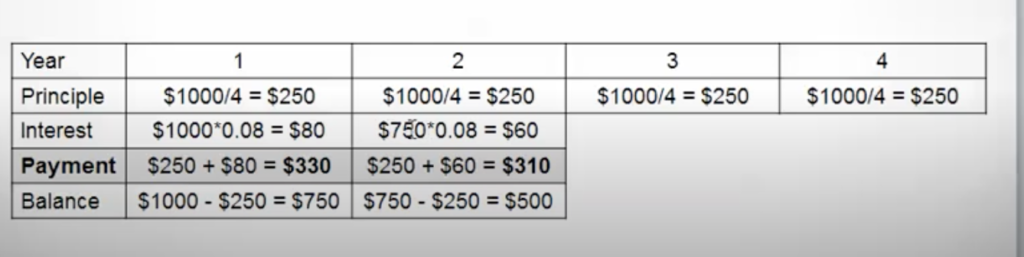

Continual Amortization Bank loan

In this Technique of lending an equal portion of the basic principle is paid at each and every period plus desire variable.(On the financial loans Remaining Harmony)Compensated in the starting of every period. Example Picture of the Schedule of Spending the Theory and the chosen phrases or additional Curiosity.

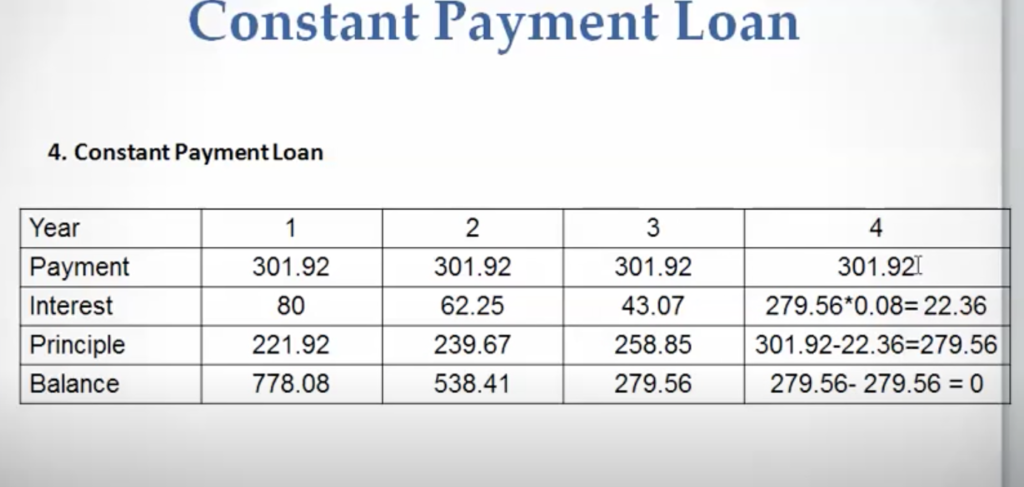

Continual Payment Bank loan

Constant Payment Personal loan is what most who buy a dwelling refer to as a Home loan. However in the earth of Real Estate this bank loan instance is a very simple Bank loan in addition fascination timetable you pay back back again more than the lifetime or period of the Basic principle.

Here is a Illustration impression of the Very simple Calculation of Consistent Payment Mortgage and Desire Schedule.

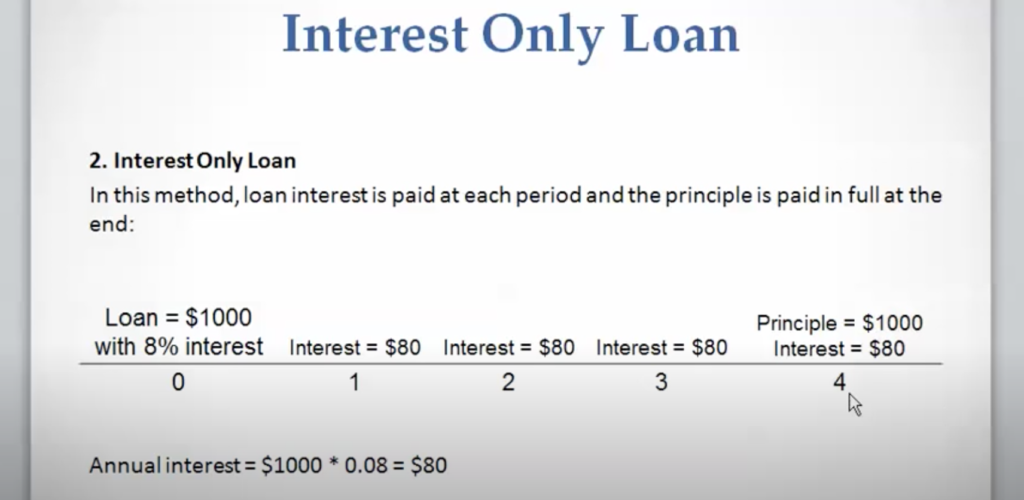

Desire Only Mortgage

An desire only Personal loan is the most straightforward sort of Interest payment financial loan plan. That means you spend a share of Curiosity on the Principal annually more than the everyday living or period of the financial loan. Till the bank loan is paid off. Simple. But listed here is a picture to exhibit to those who may have hassle computing the agenda. If your everything like myself? I always will need more aid. Your in fantastic firm.

Financial loans Curiosity payments are effortless to compute as a Company leader if you realize the basics. This article will support any one getting in True Estate of needing to investigation what Reimbursement of Financial loan fascination actually means.

I really hope you acquired anything today. As this write-up was meant to be lean and imply. I did not want to pose how to estimate the Interest payments. Due to the fact frequently situations you will turn out to be bewildered examining the verb-age. So just youtube the Payment Calculations of the bank loan forms. This submit was just meant to demonstrate what and how matters do the job in the globe of Curiosity loans and Amortization schedules. Cheers to all the Bankers in Finance, and Mortgage loan Brokers out there. This Article was sparked following I discovered that a fantastic gentleman and Titan in the New York Actual Estate Community passed very last Tuesday. Simply just I was viewing a Job interview and heard Larry begin to discuss about the Loan varieties with Son Invoice in casual Discussion. And decided I necessary to stick to up on the Finance Slang and varieties they were talking about. And Viola this publish was born.

R.I.P. to the Fantastic and Terrific Mr. Larry Ackman.

Godspeed and Cheers To Larry.

JS

.png#keepProtocol)

.png#keepProtocol)

More Stories

The Key to Boosting Retention

Kim Jong Un Unveils Ambitious ‘Regional Development Policy’ To Modernize Rural North Korea Amid Food Shortages

Industry Leader Revolutionizes Business Financing Through Credit Stacking