Table of Contents

Vitality analysts think the deep manufacturing cuts could nonetheless backfire for OPEC kingpin and U.S. ally Saudi Arabia.

Mandel Ngan | Afp | Getty Visuals

The White Household angrily pushed again at OPEC+ following the oil producer group announced its most significant provide slice since 2020, lashing out at what President Joe Biden’s administration described as a “shortsighted” choice.

Electrical power analysts imagine the deep production cuts could however backfire for OPEC kingpin and U.S. ally Saudi Arabia, particularly as Biden hinted Congress would before long search for to rein in the Middle East-dominated group’s impact around strength selling prices.

OPEC and non-OPEC allies, a group often referred to as OPEC+, agreed on Wednesday to minimize oil production by 2 million barrels for every day from November. The transfer is designed to spur a recovery in oil rates, which experienced fallen to about $80 a barrel from extra than $120 in early June.

Worldwide benchmark Brent crude futures traded at $93.55 a barrel during Thursday early morning discounts in London, up all over .2%. U.S. West Texas Intermediate futures, meanwhile, stood at $87.81, just about .1% higher.

The U.S. experienced frequently referred to as on the vitality alliance, which incorporates Russia, to pump additional to assist the world economic system and lower fuel charges ahead of midterm elections future thirty day period.

In a statement, the White Dwelling said Biden was “disappointed by the shortsighted choice by OPEC+ to reduce output quotas whilst the world wide overall economy is working with the ongoing negative affect of Putin’s invasion of Ukraine.”

It additional that Biden had directed the Office of Electricity to launch yet another 10 million barrels from the Strategic Petroleum Reserve future month.

“In light-weight of today’s motion, the Biden Administration will also seek advice from with Congress on additional resources and authorities to lessen OPEC’s regulate more than power prices,” the White Household claimed.

Whilst the team likes to say they preserve politics out of their decisions, you can find no denying that there are probable ramifications to this beyond the oil value.

Herman Wang

Running editor of OPEC and Center East information at S&P World-wide Platts

Strategists led by Helima Croft at RBC Funds Markets mentioned that whilst the U.S. signaled even further Strategic Petroleum Reserve releases had been in the offing, they had been not likely to see an additional blockbuster release in the around expression.

“A more very clear threat, in our see, is the introduction of US products export limits in a rising retail gasoline value environment,” analysts at RBC Funds Markets explained.

“Congressional action on NOPEC laws also appears like a credible outcome in light-weight of the NSC assertion about working with Congress to cut down OPEC’s over-all impact on the oil marketplace. White Residence opposition to NOPEC has served as a restraining impact on Congressional leaders,” they continued.

“Present day canine whistle may possibly be interpreted as a indication that the President will not essentially stand in the way of a floor vote on the monthly bill that would declare OPEC a cartel and issue the users to Sherman anti-rely on laws.”

What is NOPEC?

The No Oil Developing and Exporting Cartels, or NOPEC, monthly bill is intended to protect U.S. customers and firms from artificial oil spikes.

The U.S. legislation, which handed a Senate committee in early May possibly but has not yet been signed into legislation, could expose OPEC nations and associates to lawsuits for orchestrating supply cuts that elevate world crude charges.

To just take effect, the monthly bill would want to be handed by the comprehensive Senate and the Household, right before being signed into law by the president.

Top rated OPEC ministers have beforehand criticized the NOPEC invoice, warning the U.S. laws would deliver larger chaos to strength marketplaces.

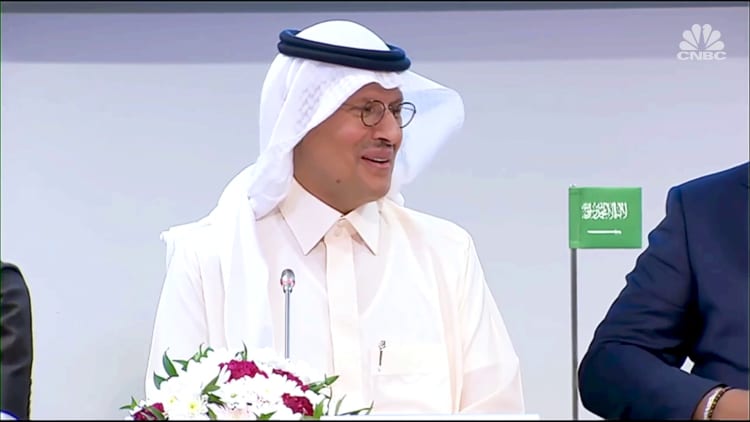

Speaking at a news conference in Vienna, Austria, on Wednesday, Saudi Strength Minister Prince Abdulaziz bin Salman said, “We will repeatedly establish that OPEC+ is right here not only to remain but listed here to remain as a moderating power to bring about balance.”

OPEC Secretary-Typical Haitham Al Ghais also defended the group’s final decision to impose deep output cuts, indicating the alliance was seeking to present “protection [and] stability to the power markets.”

Requested by CNBC’s Hadley Gamble whether OPEC+ was carrying out so at a cost, Al Ghais replied: “Every thing has a value. Electricity protection has a cost as properly.”

Only 3 months in the past, Biden arrived in Saudi Arabia on a mission to urge one of the world’s most significant oil exporters to ramp up oil output in a bid to support convey down gasoline prices. The vacation was part of an energy to improve diplomatic ties with Riyadh, which collapsed following the murder of journalist Jamal Khashoggi in 2018.

Months afterwards, even so, OPEC+ lifted oil output by a minuscule 100,000 barrels for each day in what was widely interpreted as an insult to Biden.

Questioned on Wednesday whether the group was applying vitality as a weapon adhering to its conclusion to impose deep production cuts, Saudi Arabia’s Abdulaziz bin Salman explained, “Present me where by is the act of belligerence — interval.”

OPEC+ conclusion ‘cannot stand’

Energy analysts explained the real effects of the group’s provide cuts for November was most likely to be constrained, with unilateral reductions by Saudi Arabia, the United Arab Emirates, Iraq and Kuwait probable to do the principal task.

What is far more, analysts explained it is at present difficult for OPEC+ to form a perspective much more than a thirty day period or two into the upcoming as the energy industry faces the uncertainty of more European sanctions on non-OPEC producer Russia amid the Kremlin’s onslaught in Ukraine — together with on transport insurance, price tag caps and reduced petroleum imports.

“The Saudis are saying that this was a sector-driven final decision, that they anticipate desire to drop above the winter season — I can’t see how a lower of this quantity is anything significantly less than a political statement,” Michael Stephens, an affiliate fellow at the Royal United Solutions Institute think tank in London, told CNBC.

“And even if it were being centered on specialized factors and purely offer and demand from customers, that is not how it is staying interpreted by the US. And so perception is 90% of the regulation. And the perception is the Saudis are not keeping up their finish of the discount,” he continued.

“The era we are in obviously displays that even if the Saudis coordinate with Russia on oil price ranges, that is likely to be viewed as overt help for Russia.”

Oil rates have fallen to about $80 from about $120 in early June amid developing fears about the prospect of a world wide financial economic downturn.

Bloomberg | Getty Photos

Herman Wang, running editor of OPEC and Center East news at S&P Global Platts, explained to CNBC that OPEC+ was imposing the deep output cuts with a lengthier view toward getting them via a probable world economic recession.

“But it arrives at a politically dicey time for the US, which is heading into the midterm elections, and the last detail the White House desires to see is gasoline prices spike,” Wang reported.

“That adds a geopolitical element to what OPEC+ is carrying out, and though the group likes to say they retain politics out of their choices, there is no denying that there are probable ramifications to this outside of the oil rate,” he added.

Speaking at a news convention throughout a check out to Chile, U.S. Secretary of State Antony Blinken mentioned Wednesday that Washington has built its sights very clear to OPEC associates.

Questioned irrespective of whether he was specially unhappy with U.S. ally Saudi Arabia, Blinken replied, “We have a multiplicity of passions with regard to Saudi Arabia and I consider the President laid those people out for the duration of his vacation.”

These include improving upon relations among Arab nations around the world and Israel, Yemen and operating closely with Riyadh to consider to proceed the truce, Blinken mentioned.

“But we are doing the job each and every one working day to make absolutely sure to the ideal of our capacity that, yet again, power supply from where ever is basically meeting demand from customers in buy to assure that power is on the industry and that price ranges are held lower.”

Sen. Bernie Sanders, I-Vt., claimed via Twitter: “OPEC’s final decision to cutback on generation is a blatant try to boost gas prices at the pump that simply cannot stand.”

“We should finish OPEC’s illegal rate-repairing cartel, eradicate navy assistance to Saudi Arabia, and transfer aggressively to renewable strength,” he added.

.png#keepProtocol)

.png#keepProtocol)

More Stories

The Key to Boosting Retention

Kim Jong Un Unveils Ambitious ‘Regional Development Policy’ To Modernize Rural North Korea Amid Food Shortages

Industry Leader Revolutionizes Business Financing Through Credit Stacking