A lot has been built of the headwinds the ecommerce section has occur up in opposition to in new occasions. Ongoing offer chain and inflationary pressures amidst slowing buyer discretionary paying and the effects of the economy’s reopening have all impeded the sector’s progress.

And as was evident in a disappointing Q1 report, Amazon (AMZN) has felt the pinch far too.

J.P. Morgan’s Doug Anmuth thinks the macro headwinds will still have a big element to participate in in Q2 – significantly in the initial half – nonetheless as comps simplicity in the latter fifty percent of the 12 months, and Amazon makes further headway in “key below-penetrated categories” this sort of as grocery, CPG, attire & add-ons, & household furniture/appliances/gear, profits expansion ought to also pick up steam in 2H22.

There is also an additional aspect to contemplate when assessing Amazon’s around-term prospective clients. The enterprise has invested heavily more than the previous pair of several years the workforce has practically doubled to 1.6 million, though the achievement community is now twice as large. But the corporation now seems to have also substantially capability – both of those in the workforce and infrastructure wise.

That claimed, Amazon has currently claimed this year’s success capex would be lower than last yr, although transportation capex need to also come in “flat to somewhat down.” The outcome should be an over-all reduction of ~55% of the complete capex commit as opposed to last year.

The slowdown in paying need to also prove advantageous to OI margins, which Anmuth expects will increase as the yr progresses.

“Macro variables will consider for a longer time to perform out,” extra the 5-star analyst, “but the organization has lifted Key price ranges & introduced a gas surcharge to offset, & we assume AMZN to increase into its upfront shelling out far more in 2H22.”

Somewhere else, AWS observed out Q1 with a backlog of $88.9 billion – its most important at any time – while development accelerated to 68% 12 months-over-year. Anmuth thinks 30%+ AWS earnings progress is “sustainable” in 2022, and as comps simplicity, Promotion should really also see a major uptick.

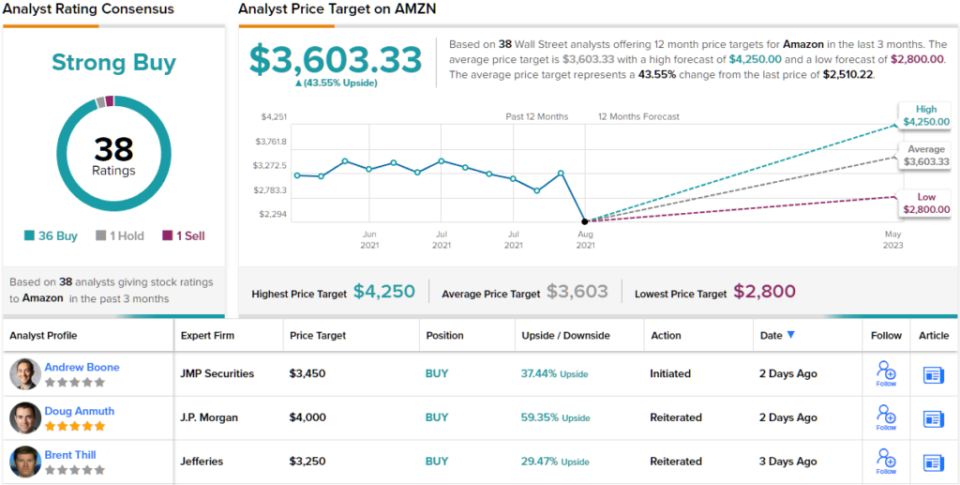

All in all, Anmuth phone calls Amazon his “Best Thought,” and reiterated an Over weight (i.e., Buy) rating together with a $4,000 value focus on. The implication for buyers? Upside of 59%. (To check out Anmuth’s keep track of record, click here)

The Street’s cadre of analysts practically unanimously agree of the 38 opinions on file, 36 are to Buy, making the consensus look at on this stock a Strong Get. Going by the ordinary goal of $3,603 and change, shares are expected to climb ~44% increased in the year ahead. (See Amazon inventory forecast on TipRanks)

To discover very good tips for shares buying and selling at interesting valuations, stop by TipRanks’ Greatest Stocks to Acquire, a newly introduced resource that unites all of TipRanks’ fairness insights.

Disclaimer: The viewpoints expressed in this posting are only all those of the highlighted analyst. The articles is meant to be utilized for informational purposes only. It is incredibly crucial to do your possess examination prior to creating any investment.

.png#keepProtocol)

.png#keepProtocol)

More Stories

‘The Forest Must Stay!’ Treetop Protest Erupts At Tesla’s Berlin Gigafactory As Activists Try To Thwart Expansion – Tesla (NASDAQ:TSLA)

GamerSafer acquires Minecraft-focused Minehut server community

New York Appeals Court allows Trump, sons to continue running business, denies request to delay payment