Table of Contents

Artificial intelligence is already beginning to transform a number of accounting and tax tasks—helping to streamline processes, enhance accuracy, and identify potential areas of fraud or compliance risk.

The recent surge in AI applications promises to heighten efficiency and accuracy in many areas of business operations, and accounting and tax functions are no exception, especially as businesses grapple with increasingly complex financial data and regulatory demands.

To get the best from AI, and avoid potentially costly mistakes, it is important to identify the areas of accounting and tax work in which the technology delivers the most upsides, and to implement a robust governance and risk framework to minimize potential downsides.

We look below at how and where AI can play a beneficial role.

Multi-Dimensional Augmentation

First, it is important to view AI as a way of augmenting accounting and tax work, not replacing it. Like all business services, accounting and tax services rely profoundly on people’s ability to form trusted relationships and provide meaningful, targeted expertise across not always obviously related fields, as well as potentially multiple jurisdictions.

AI is still a long way from being able to replicate the “human touch,” but it is already proving useful in several areas of accounting and tax practice. The transformative impact of AI in accounting and tax is evident through its key applications:

- Narrow AI streamlining routine tasks such as automated data entry and tax compliance work

- Machine learning powering predictive financial analytics or fraud detection processes

- Natural language processing enhancing document understanding and categorization

- Computer vision interpreting visual data for efficient workflows such as receipt and invoice processing

- Expert systems ensuring compliance through rule-based decision support such as tax compliance and technical accounting processes

Governance and Risk Framework

As AI works its way into more accounting and tax functions, establishing a robust governance and risk framework becomes paramount.

Fundamentally, the integration of AI should align with the organization’s strategic goals and risk appetite. Clearly defining the objectives of deploying AI in accounting and taxation is crucial for guiding its implementation and measuring its success.

The development of a governance structure should ideally be the work of a cross-functional governance board, incorporating IT, accounting and tax, compliance, and risk management leaders. There need to be clearly defined roles and responsibilities for AI oversight, and policies for AI deployment, covering aspects such as procurement, development, and data management.

Once these have been agreed, there needs to be a thorough risk assessment around AI implementation, evaluating aspects such as accuracy, compliance, and cybersecurity across a range of potential applications to help define a governance framework.

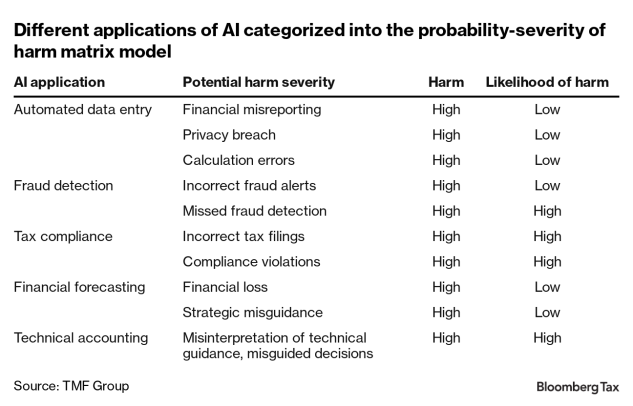

It might be useful to construct an AI governance model that includes a probability–severity of harm matrix, such as the one shown below (referred to as the Singapore Model Governance AI Framework) to help identify the AI applications that are ripe for implementation, with thorough human oversight, and those that should be avoided for now.

Here are a few examples of how this model might be used to develop action points and safeguards across different AI applications:

Automated data entry. The probability of harm may be low when the system is well-trained and the data quality is high. Nevertheless, the severity of harm could be significant if errors occur, leading to inaccurate financial records or regulatory compliance issues.

With a high/low severity–probability rating, AI would need to be implemented with processes for data validation with human oversight in the form of quality checks, regular audits to detect any discrepancies, and continuous training of the AI model. Additionally, incorporating user-friendly interfaces can empower users to review and validate automated entries, further reducing the likelihood of harmful errors.

Tax compliance. The probability of harm may increase when the AI model encounters novel or rapidly changing tax regulations, potentially leading to misinterpretation or oversight. The severity of harm in such instances could result in financial penalties, audits, or legal consequences.

With its high/high rating, this application would require the involvement of tax compliance experts to validate AI-generated tax filings and ensure compliance with tax regulations. Periodic reviews by tax professionals would also be required to implement a dual-check system with human tax experts, which can further reduce the probability of harmful errors, ensuring appropriate integration of AI into tax compliance processes.

Technical accounting. The probability of harm may increase in dynamic financial environments with frequent regulatory changes, challenging the AI model’s ability to stay updated. The severity of harm is significant, as inaccuracies in financial reporting can lead to misguided business decisions and regulatory non-compliance.

Companies should implement a robust system for training and monitoring AI models, using the latest accounting standards and regulatory updates. The organization should involve accounting professionals with expertise in technical accounting in the development and validation of AI algorithms.

This application of AI would also require regular reviews of the performance of the AI model—and updates to it when required—along with periodic external audits by independent auditing firms to evaluate the accuracy and compliance of AI-driven technical accounting analyses.

Looking Forward

The integration of AI in accounting and taxation promises new levels of efficiency, accuracy, and strategic insight. However, this integration isn’t without its challenges.

Implementing a robust governance and risk framework is crucial for harnessing AI’s potential and mitigating associated risks.

Getting the best out of an AI-augmented future demands a strategic, well-governed approach. This ensures that AI catalyzes growth and innovation while maintaining the highest standards of accuracy, compliance, and ethical practice.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Csaba Farkas is global head of accounting and tax consultancy at TMF Group.

Write for Us: Author Guidelines

.png#keepProtocol)

.png#keepProtocol)

More Stories

‘The Forest Must Stay!’ Treetop Protest Erupts At Tesla’s Berlin Gigafactory As Activists Try To Thwart Expansion – Tesla (NASDAQ:TSLA)

GamerSafer acquires Minecraft-focused Minehut server community

New York Appeals Court allows Trump, sons to continue running business, denies request to delay payment